On September 25, 2025, the

Plasma (XPL) blockchain officially launched its mainnet beta alongside its native token XPL, debuting on major exchanges such as BingX. Early trading saw XPL surge to $1.54 before retreating to the $0.90–$1.10 range, giving the token a market capitalization of $1.9–$2.4 billion and an $8.6–$10.4 billion fully diluted valuation (FDV).

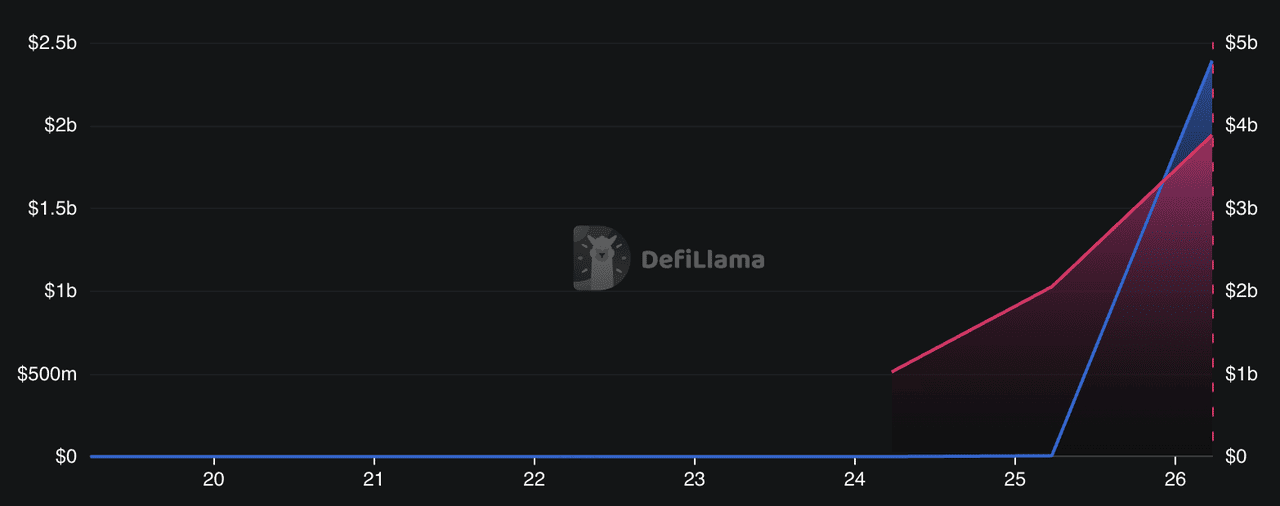

Plasma's TVL and stablecoins' market cap | Source: DefiLlama

Backed by leading investors including Tether CEO Paolo Ardoino and PayPal co-founder Peter Thiel, Plasma positions itself as a Layer-1 blockchain optimized for

stablecoins, with over $2 billion in total value locked (TVL) at launch. The debut was accompanied by one of the most notable airdrops of the year: every ICO pre-deposit participant received approximately 9,304 XPL valued at around $8,390, regardless of deposit size.

This article explores the launch of Plasma’s XPL token, its $25M airdrop rewarding ICO partic

ipants with $8,390 each, and provides a detailed price prediction and investor outlook after the September 25 debut.

What Is Plasma (XPL) and How Does It Work?

Plasma is a Layer-1 blockchain purpose-built for stablecoin efficiency, designed to act as a high-throughput “money chain.” Its standout feature is the ability to process gasless USDT transfers for simple send-and-receive transactions, making stablecoin payments near-instant and fee-free. For more complex operations, such as deploying smart contracts or running decentralized applications, users pay gas in XPL or convert a portion of stablecoins into XPL to cover fees.

The network is fully EVM-compatible, meaning developers can migrate

Ethereum-based dApps without modification, lowering the barrier to adoption and ensuring broad ecosystem compatibility.

What Is the XPL Token Utility?

The native token, XPL, plays three core roles within Plasma’s architecture:

• Gas token for executing transactions and smart contracts.

• Staking asset used to secure the network through its consensus mechanism.

• Reward token for validators, distributed under an inflationary model that begins at 5% annually and gradually decreases to 3%.

Plasma (XPL) Tokenomics Overview

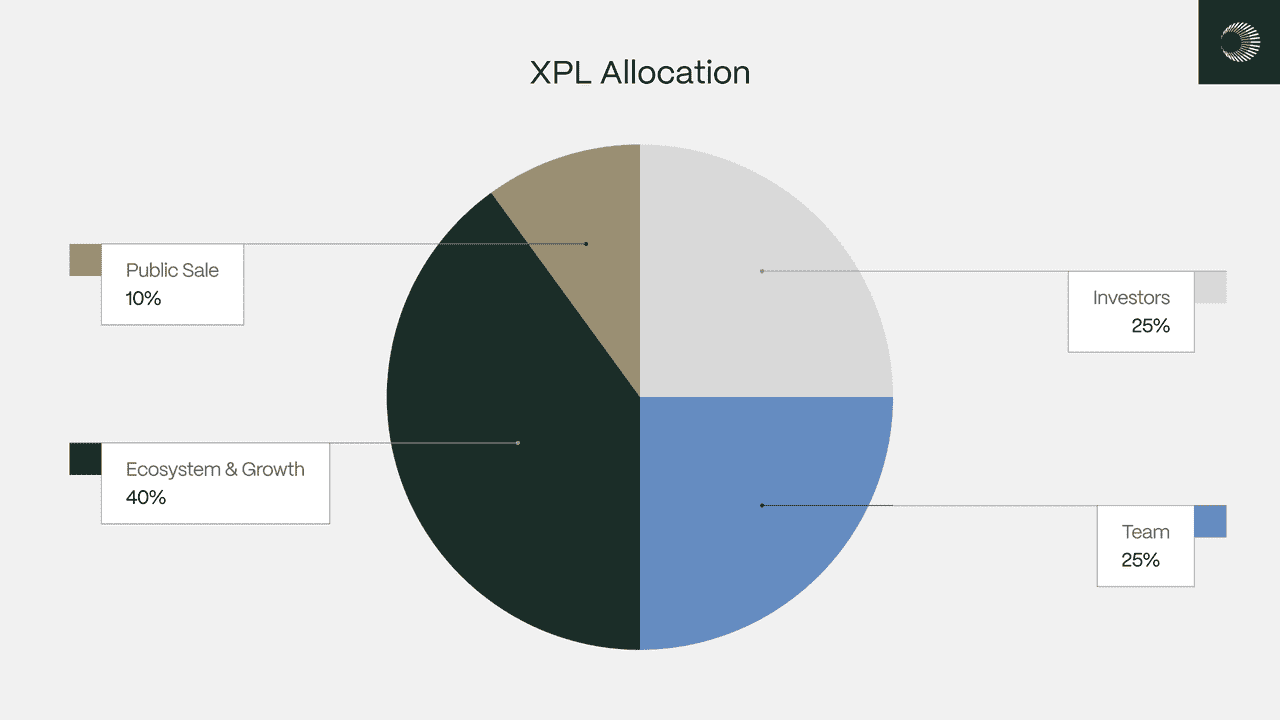

XPL token allocation | Source: Plasma announcement

Plasma’s launch introduced a 10 billion XPL total supply, with 1.8 billion (18%) in circulation at debut. The supply is distributed as follows:

• 40% to ecosystem and growth, with 8% unlocked at launch, and remainder vesting monthly over 3 years.

• 25% to team and founders, with 1-year cliff, 2-year vesting.

• 25% to investors and strategic partners, with same vesting as the team.

• 10% to public and ICO participants, following an oversubscribed $300 million sale at a $500 million FDV.

This structure front-loads liquidity for early ecosystem growth while phasing in investor and team allocations to minimize immediate dilution. However, investors should monitor vesting cliffs in 2026, which could introduce sell-side pressure as locked allocations begin to unlock.

Plasma’s $25M XPL Airdrop: $8,390 for Every ICO Pre-Deposit Participant

Plasma marked its September 25, 2025 launch with one of the most notable community airdrops of the year. The project allocated 25 million XPL, worth $25M at launch prices, to ICO pre-deposit participants, distributing the tokens equally regardless of deposit size. Each eligible user received about 9,304 XPL, worth roughly $8,390 at debut pricing, making it a rare instance where small and large depositors benefited equally.

Eligibility extended to anyone who locked funds during Plasma’s pre-deposit ICO round earlier in 2025, even if they did not convert their allocation into tokens during the actual sale. This inclusive design generated strong goodwill among retail investors and quickly amplified social media buzz. Notably, around half of participants claimed their allocations within the first three hours of mainnet going live.

By rewarding over a billion dollars’ worth of pre-deposit commitments with a level playing field, Plasma not only injected immediate liquidity into its ecosystem but also created powerful momentum for its token debut. The airdrop’s unique structure positioned XPL as a launch that prioritized community trust and engagement while fueling speculative demand in its first days of trading.

What the Plasma (XPL) Airdrop Means for Traders and Early Investors

Plasma’s mainnet launch and the accompanying $25M airdrop have created a unique starting point for both early supporters and new market entrants. The airdrop instantly rewarded ICO pre-deposit participants with roughly 9,304 XPL each, worth around $8,390 at launch prices, giving thousands of small retail users liquidity from day one. For traders, this sudden injection of tokens into circulation set the stage for heavy speculation, sharp price swings, and record trading volumes.

1. Early Liquidity and Market Access

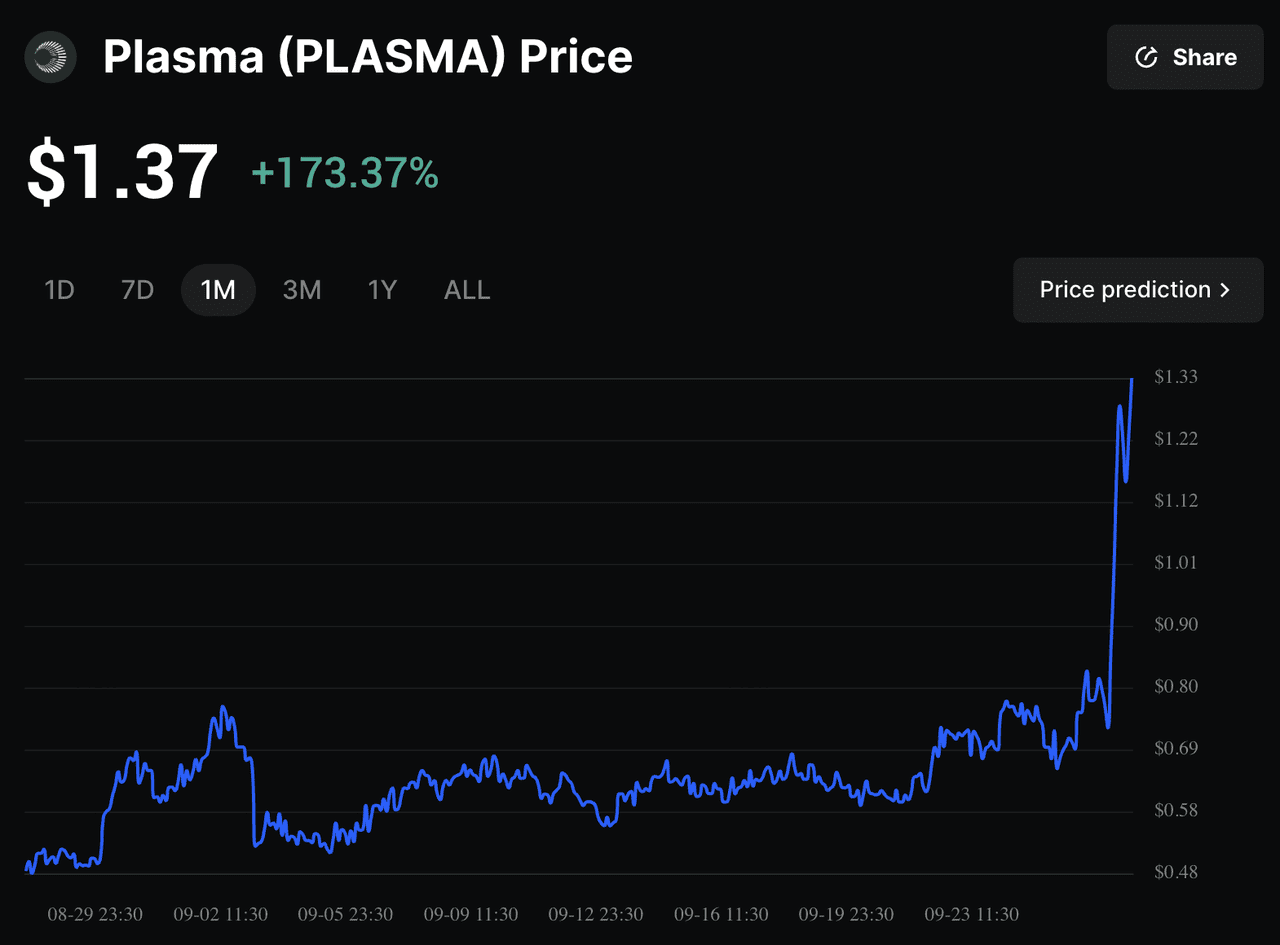

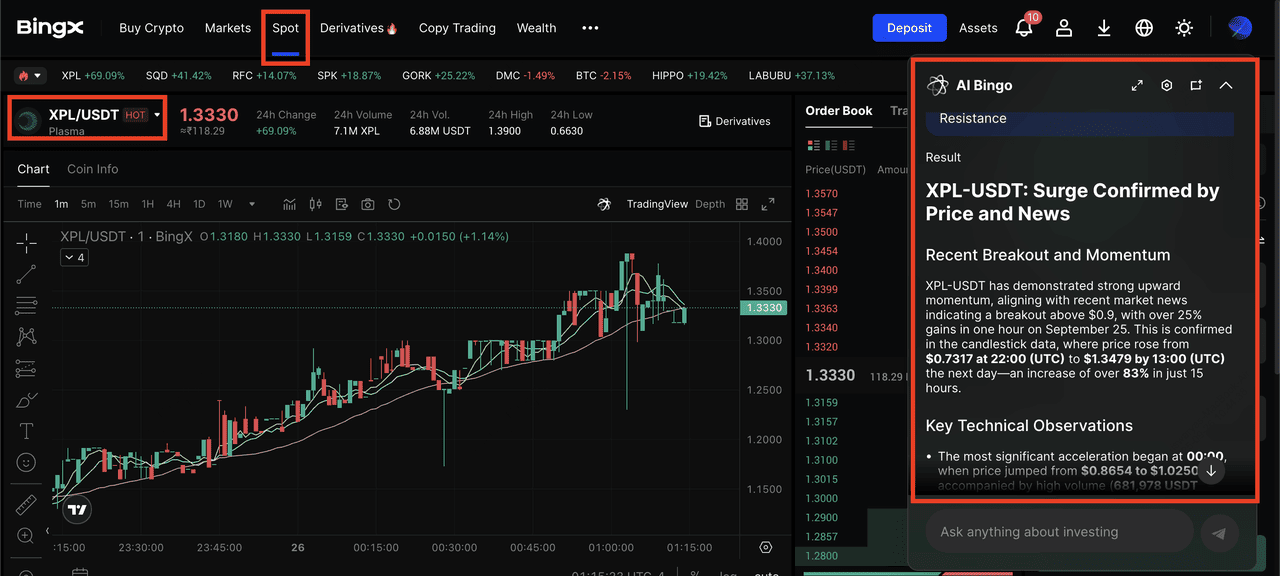

Plasma (XPL) price trends after launch | Source: BingX

Within 24 hours of launch, XPL trading volumes exceeded $5.5 billion, split across decentralized exchanges like Uniswap and PancakeSwap, and centralized exchanges, including BingX. Prices peaked at $1.54 before retracing to the $0.90–$1.10 range, creating opportunities for both short-term profit-taking and accumulation. ICO buyers who entered at $0.05 per token briefly realized 20x returns, showing just how volatile early trading can be. For beginners, this means using limit orders, avoiding overexposure, and tracking liquidity depth are critical to managing risk.

2. Institutional and Whale Influence

Large buyers played a defining role in XPL’s debut. One whale alone deployed 50 million USDT in the public sale, securing around 54 million XPL at $0.05. This single allocation grew to over $50 million in value within hours, underscoring how concentrated holdings can shape market direction. Retail investors should monitor whale wallets and exchange inflows, as profit-taking by large holders can trigger sudden price drops.

3. Plasma Ecosystem Catalysts Driving Demand

Beyond trading hype, Plasma’s fundamentals attracted attention at launch. More than $2.05 billion in stablecoins was already active on-chain, with integrations from major DeFi protocols like

Aave,

Euler,

Ethena, and Fluid. Plasma also introduced Plasma One, a stablecoin-native neobank offering cross-border digital dollar services, and partnered with Swarm to

tokenize equities such as

Apple,

Microsoft, and

Tesla. These products signal that demand for XPL could extend beyond speculation, as real-world use cases begin to materialize.

4. Supply Dynamics and Long-Term Risks

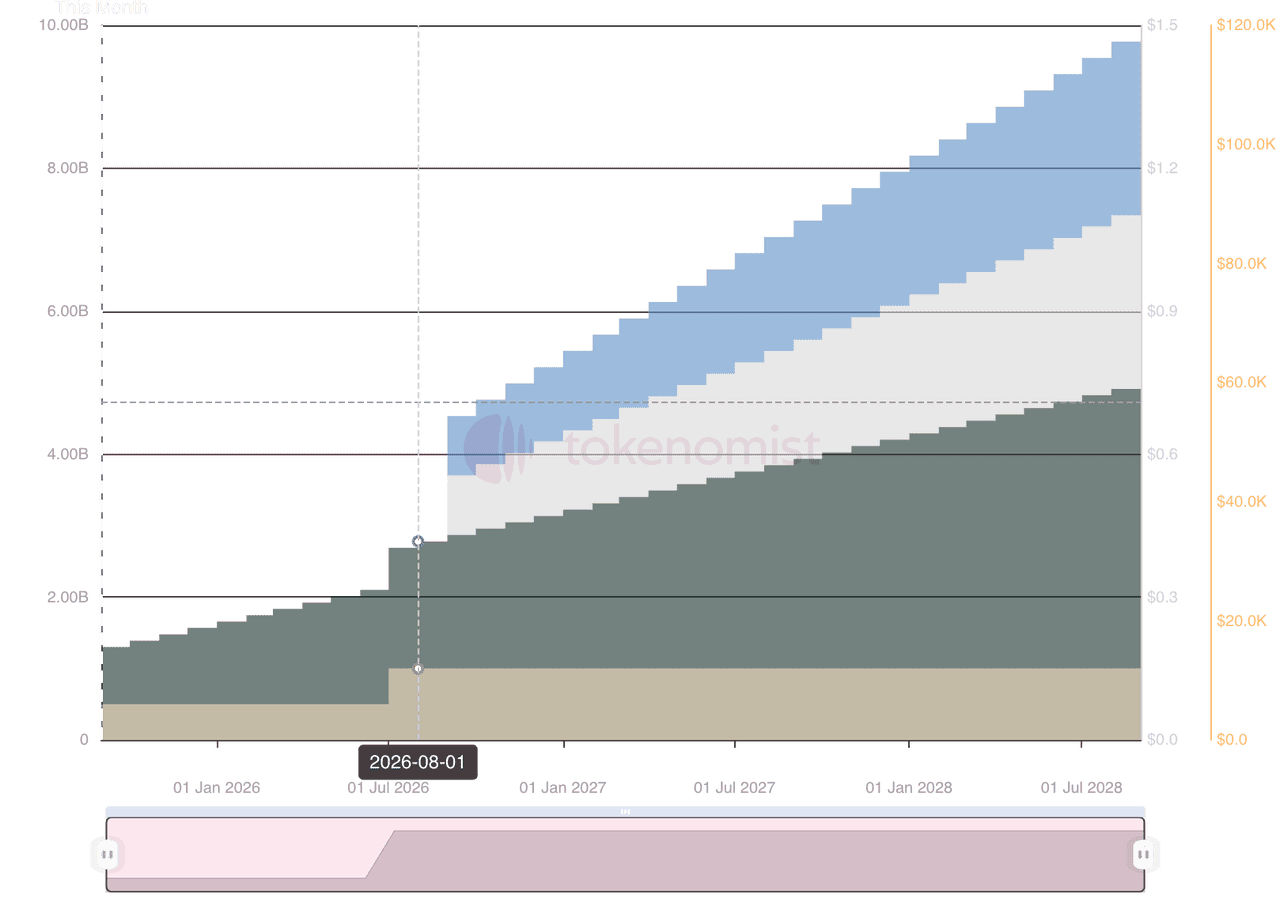

XPL token vesting schedule | Source: Tokenomist.ai

Although 1.8 billion tokens or 18% of supply are in circulation as of September 2025, some allocations remain locked, particularly for U.S. public sale participants who cannot access tokens until July 2026. While this reduces near-term selling pressure, it also sets up potential future dilution. Traders should note these vesting cliffs, as unlock events often act as catalysts for volatility and supply-driven downturns.

For early traders, the XPL launch provides both upside and risk. High liquidity, large airdrop allocations, and ecosystem partnerships could support strong momentum in the short term. At the same time, whale influence, sharp volatility, and long-term unlock schedules demand careful position sizing, profit-taking strategies, and disciplined risk management.

How to Trade Plasma (XPL) on BingX

Plasma’s XPL token is now listed on BingX, giving traders access to both spot and futures markets. Whether you want to accumulate for the long term or trade short-term volatility, BingX provides the tools, and

BingX AI insights, to navigate XPL’s early price action effectively.

Buying and Selling XPL on the Spot Market

XPL/USDT trading pair on the spot market, powered by AI Bingo insights

On BingX, you can trade

XPL/USDT directly in the

spot market. Spot trading is the simplest way to gain exposure to Plasma’s ecosystem and is suitable for long-term holders. Given XPL’s sharp volatility, spiking to $1.54 at launch before retracing below $1.00, using limit orders is recommended to avoid slippage.

Beginners can also apply

dollar-cost averaging (DCA) to gradually build positions. To refine entries, BingX AI provides real-time signals and market insights, helping traders identify support and resistance levels before executing spot trades.

Going Long or Short on XPL on the Futures Market

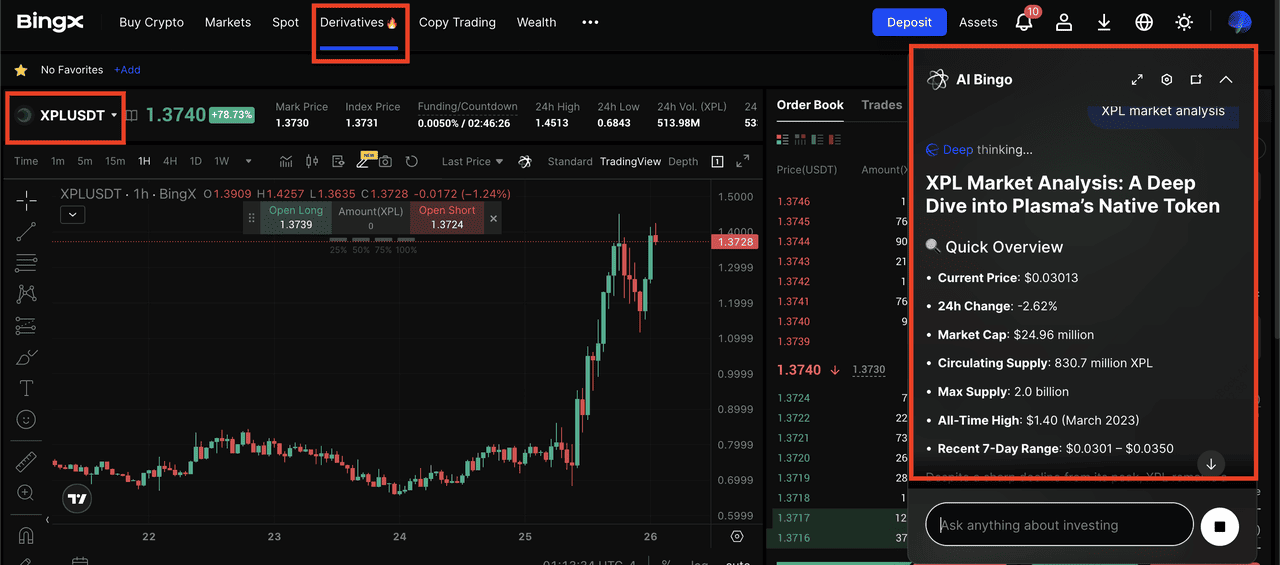

XPL/USDT perpetual contract on the futures market powered by BingX AI

BingX also offers

XPL/USDT perpetual futures, which let you go long if you expect prices to rise or short if you anticipate a correction.

Futures trading allows the use of leverage, amplifying both gains and risks.

Traders should use isolated margin, set

stop-loss orders, and size positions carefully to manage downside exposure. Here too, BingX AI can be used to monitor funding rates, sentiment shifts, and whale wallet flows, data that can be critical in timing leveraged entries and exits.

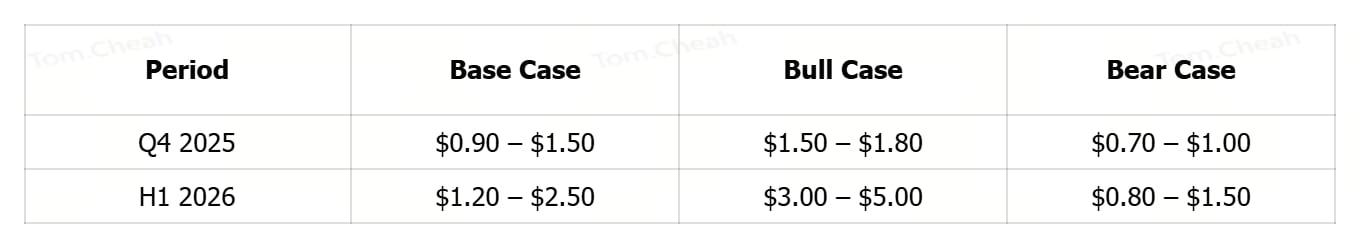

Plasma (XPL) Price Prediction: Near-Term Outlook

The outlook for XPL remains highly contested after its volatile debut. Within hours of launch, the token surged to $1.54 before retracing below $1.00, highlighting how quickly sentiment can shift in new listings. Trading volumes topped $5.5 billion in the first 24 hours, suggesting strong speculative interest but also pointing to thin liquidity pockets where sharp moves are possible.

Analysts are split: some see consolidation in the $1.00–$1.80 band as the market absorbs early supply, while others believe momentum and whale inflows could drive XPL toward the $3–$5 range by early 2026 if adoption accelerates.

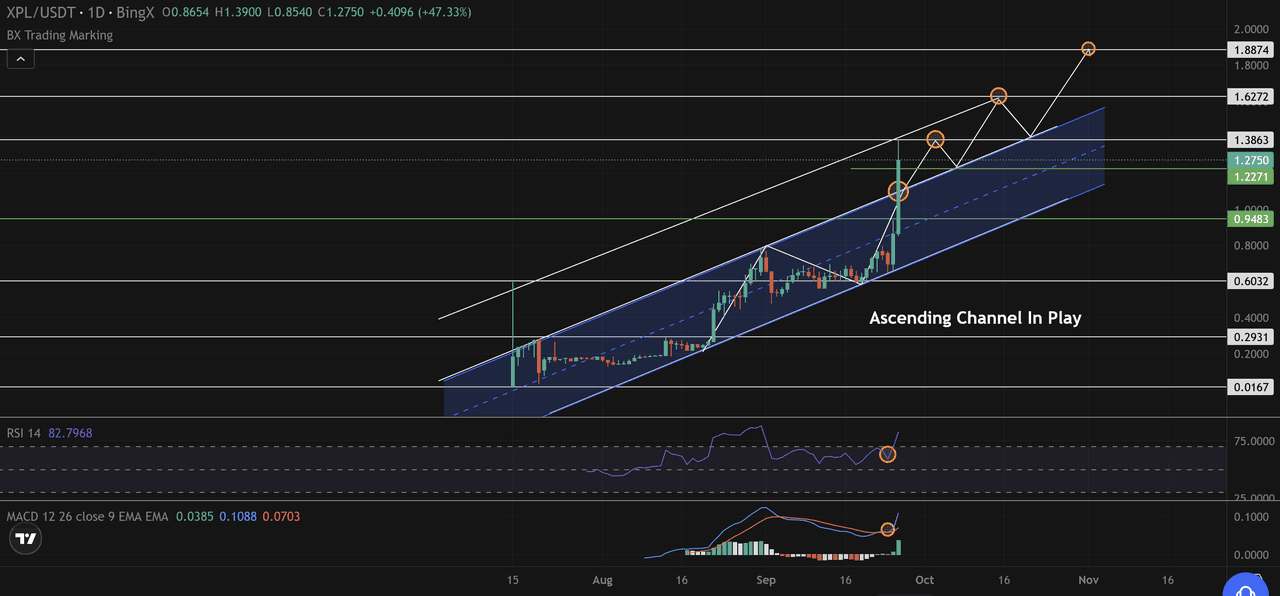

Plasma (XPL) Technical Analysis: Breakout Above $1.20 Targets $1.62 and $1.88

Plasma has advanced to $1.24, posting nearly 50% gains in just 24 hours. On the daily chart, XPL broke out of a rising

parallel channel that had guided its price since mid-August. The decisive green candle piercing the upper boundary on strong volume signals a major shift in market structure.

Candlestick action adds weight to this view. The breakout candle formed a

bullish engulfing pattern, showing that buying pressure overtook earlier attempts to cap the rally.

From a pattern perspective, the channel breakout projects potential targets higher. The next resistance level sits around $1.38, followed by $1.62, and then $1.88 at the upper measured move of this advance. If profit-taking sets in, support can be found near $0.95, the midpoint of the prior channel, with stronger backing at $0.60 if the pullback deepens.

For traders, the immediate setup is straightforward: maintaining closes above $1.20 keeps the breakout intact and leaves room for a run toward $1.62 and possibly $1.88. If this structure holds, Plasma could remain one of the stronger performers into the next trading cycle.

Plasma (XPL) Forecast for 2025 and 2026

Plasma’s launch is backed by over $2B in stablecoins and early integrations with Aave and Euler, while Plasma One targets high-demand regions like the Middle East. Still, risks loom from 2026 unlocks covering 50% of supply, regulatory scrutiny, and whale concentration, including a 50 million USDT entry at $0.05. In the near term, $1.00 is key support and $1.80 resistance; a breakout could push XPL toward $2–$3, while a breakdown risks $0.70. Traders should use staged entries, stop-losses, and track unlock schedules closely.

Final Word

The launch of Plasma and its native token XPL marks a bold attempt to build a stablecoin-centric blockchain with strong institutional backing and retail goodwill. With over $2B in TVL at debut, a generous airdrop to ICO participants, and listings across major exchanges, XPL enters the market with strong visibility.

However, the road ahead will be shaped by adoption metrics, regulatory developments, and how well Plasma differentiates itself from competing networks. In the near term, $1.00–$1.80 appears to be the most plausible trading range, with upside possible if stablecoin demand accelerates.

For investors, XPL remains a high-risk, high-volatility asset. Approaching it with disciplined risk management, clear trading strategies, and ongoing monitoring of supply unlock schedules will be crucial.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investments carry risk, and you should never invest more than you can afford to lose.

Related Reading