This means more tokens entering the market, which can sometimes create price swings if demand doesn't keep up. October will test how well different markets can absorb fresh supply. Some tokens may face selling pressure, while others could hold steady if buying interest and community support remain strong.

What Are Token Unlocks?

Token unlocks are scheduled releases of tokens that were previously locked under a vesting schedule, often reserved for project teams, early investors, or community incentives. These lockups are designed to align long-term commitment with project growth and prevent large sell-offs at launch. When an unlock occurs, the circulating supply of a token increases. If recipients sell, it can create downward pressure on prices, especially if the unlock is large relative to existing float.

On the other hand, if the market absorbs the new supply, through strong demand, staking, or long-term holders, it can be a sign of confidence in the project's fundamentals. The impact of an unlock depends on factors such as the size of the release compared to circulating supply, who receives the tokens, and overall market sentiment at the time. Discover the top crypto token unlocks in October 2025, including Sui, EigenCloud, Ethena, and Arbitrum, and learn how these events may impact market volatility and trading opportunities.

Why Do Token Unlocks Matter?

Token unlocks serve as real-time stress tests for crypto projects. If the market absorbs the new supply through staking, liquidity provision, or long-term holding, it reflects strong confidence. But if tokens flood the market and trigger heavy sell-offs, it can shake investor sentiment and push prices down. With $3.9 billion worth of tokens set to be released this month, October may become one of the most turbulent and exciting periods of the year

October 2025 Token Unlocks: The Big Picture

Here's what stands out this month:

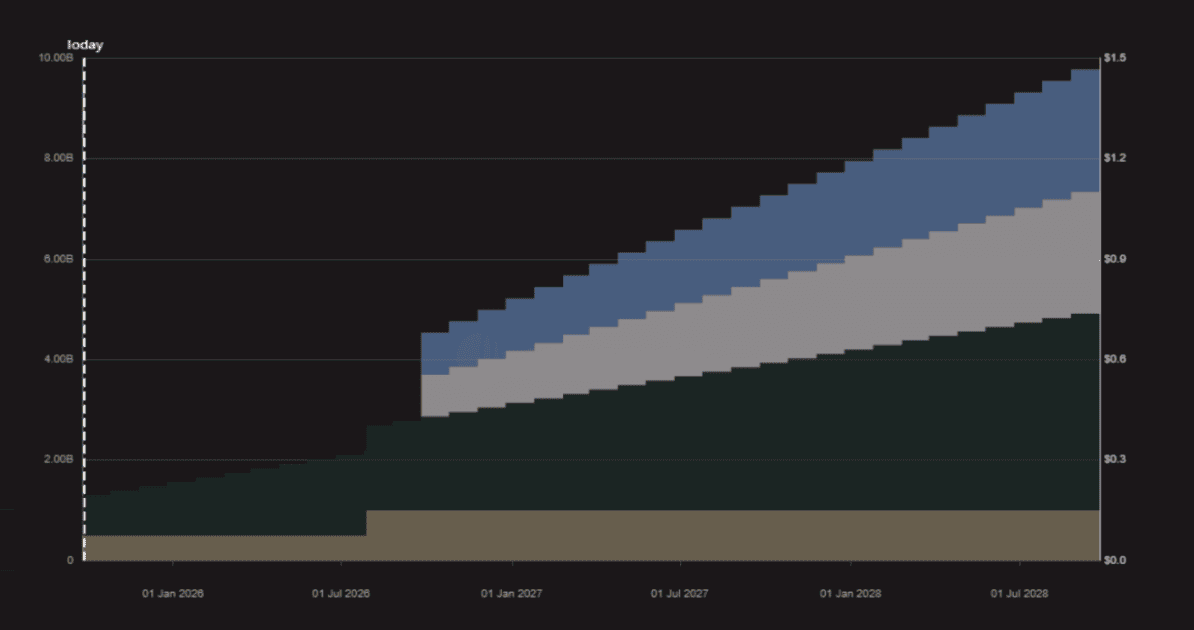

• According to

Capital Altcoin, $1 billion will be released in one-time cliff unlocks, while $2.9 billion will be spread out gradually through linear unlocks.

• Aster (ASTER) leads with the largest single release, making it the key project to watch.

• A unique case is XPL, the native token of Plasma, a stablecoin-focused layer 1 supported by Tether, which launches with an opening market cap of $1.7B, introducing zero-fee USDT transfers via its PlasmaBFT consensus.

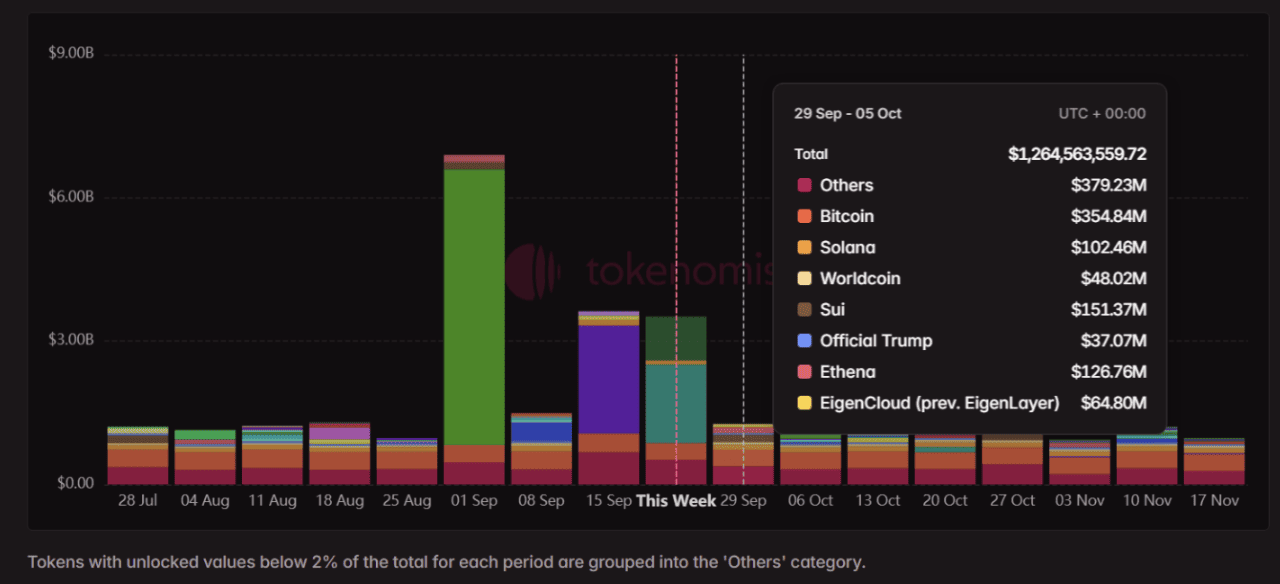

• According to

BeInCrypto, in just the first week of October (Oct 1–7), over $773 million worth of insider tokens hit the market. Sui (SUI) led the way with a major unlock that could push its price amid high volatility, while smaller projects like Spectral (SPEC),

Quack AI (Q), and

Immutable (IMX) also saw potential weakness as new supply met limited demand.

October is packed with major token unlocks across leading projects, and tracking these events is essential for traders to anticipate supply shifts and potential volatility.

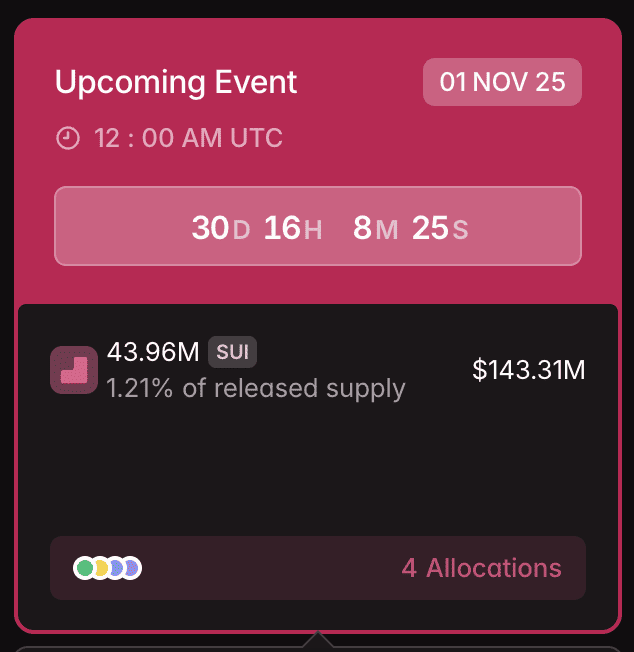

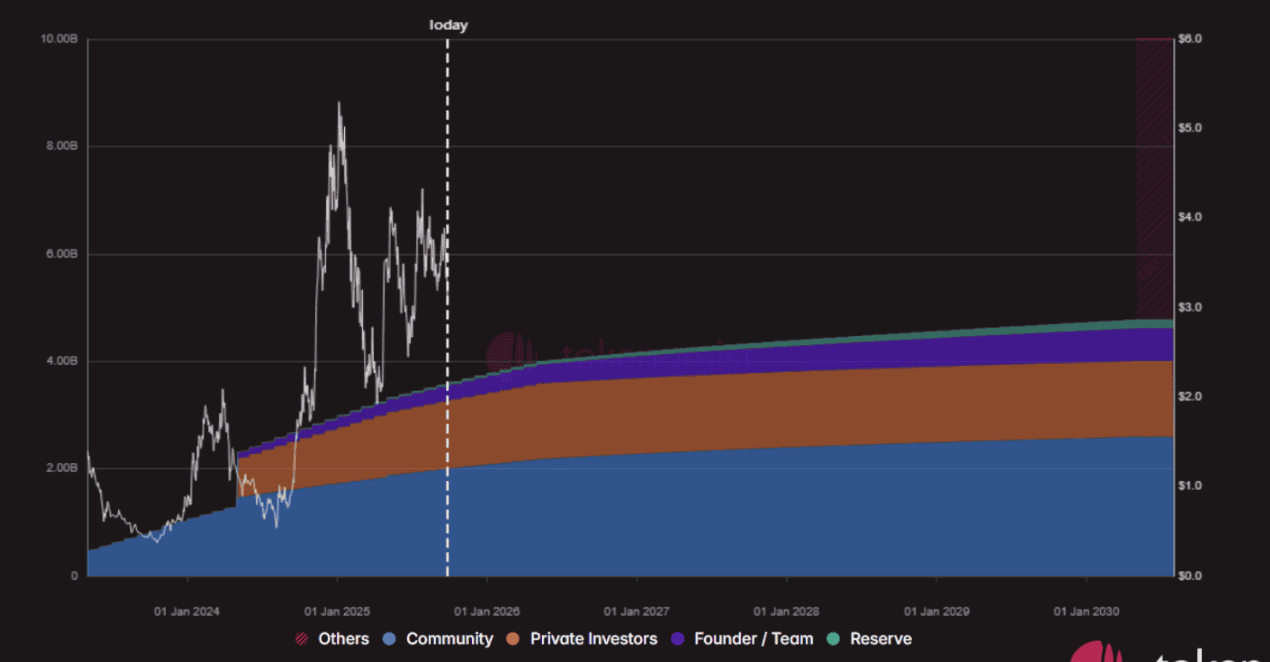

1. Sui (SUI)

Date: October 1, 2025

SUI token unlock schedule

Sui kicks off October with its biggest unlock, valued at $145.18M–$180.40M, making it the month's most closely watched release. The combination of cliff and linear unlocks adds both immediate and ongoing supply pressure. The network will unlock 44 million SUI tokens, representing 1.23% of its released supply and 0.44% of total supply. Of the unlocked supply, 19.32 million SUI will go to Series B investors, community reserve and early contributors will get 12.63 million and 9.98 million SUI, respectively, and Mysten Labs will receive 2.07 million tokens. Given that Sui has a current circulating supply of 3.568 billion SUI out of 10 billion total, this event could significantly influence its price and market sentiment.

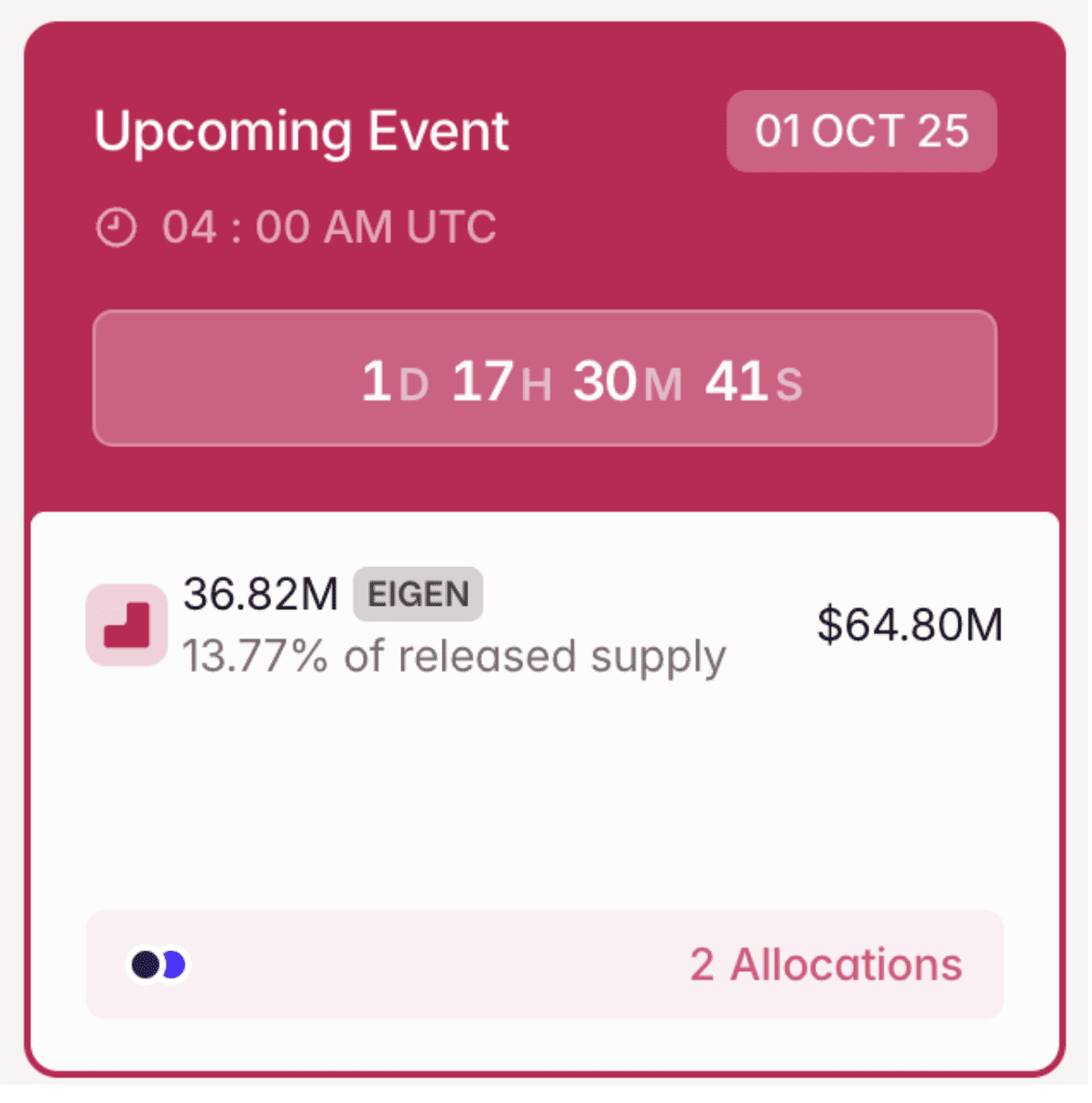

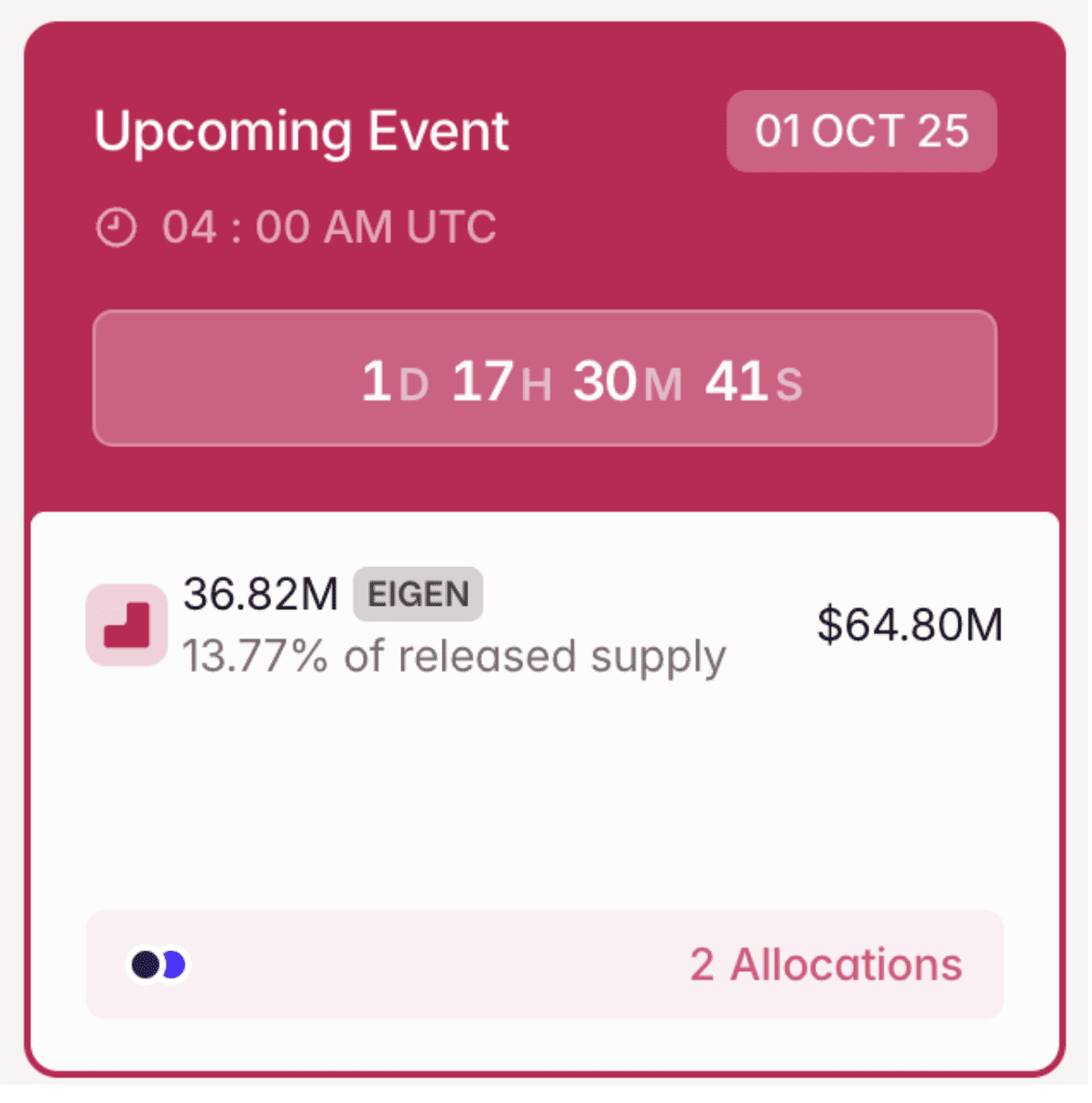

2. EigenCloud (EIGEN)

• Unlock Date: October 1, 2025

• Number of Tokens to be Unlocked: 36.82 million EIGEN (2.1% of Total Supply)

• Current Circulating Supply: 339.49 million EIGEN

• Total Supply: 1.749 billion EIGEN

EigenCloud (formerly EigenLayer), a verifiable cloud platform built on the EigenLayer protocol, will release 36.82 million tokens worth around $64.80M, representing 2.1% of its total supply and 13.77% of released supply, at the scheduled time. This unlock is relatively modest compared to larger projects but still notable due to EigenCloud's role in creating trustless, verifiable Web3 applications. The team will split the unlocked supply in two ways: investors will gain 19.75 million tokens, and early contributors will get 17.07 million EIGEN. With a current circulating supply of 339.49 million EIGEN out of 1.749 billion total, validator rounds and ecosystem liquidity may shift depending on how much of the released supply enters circulation.

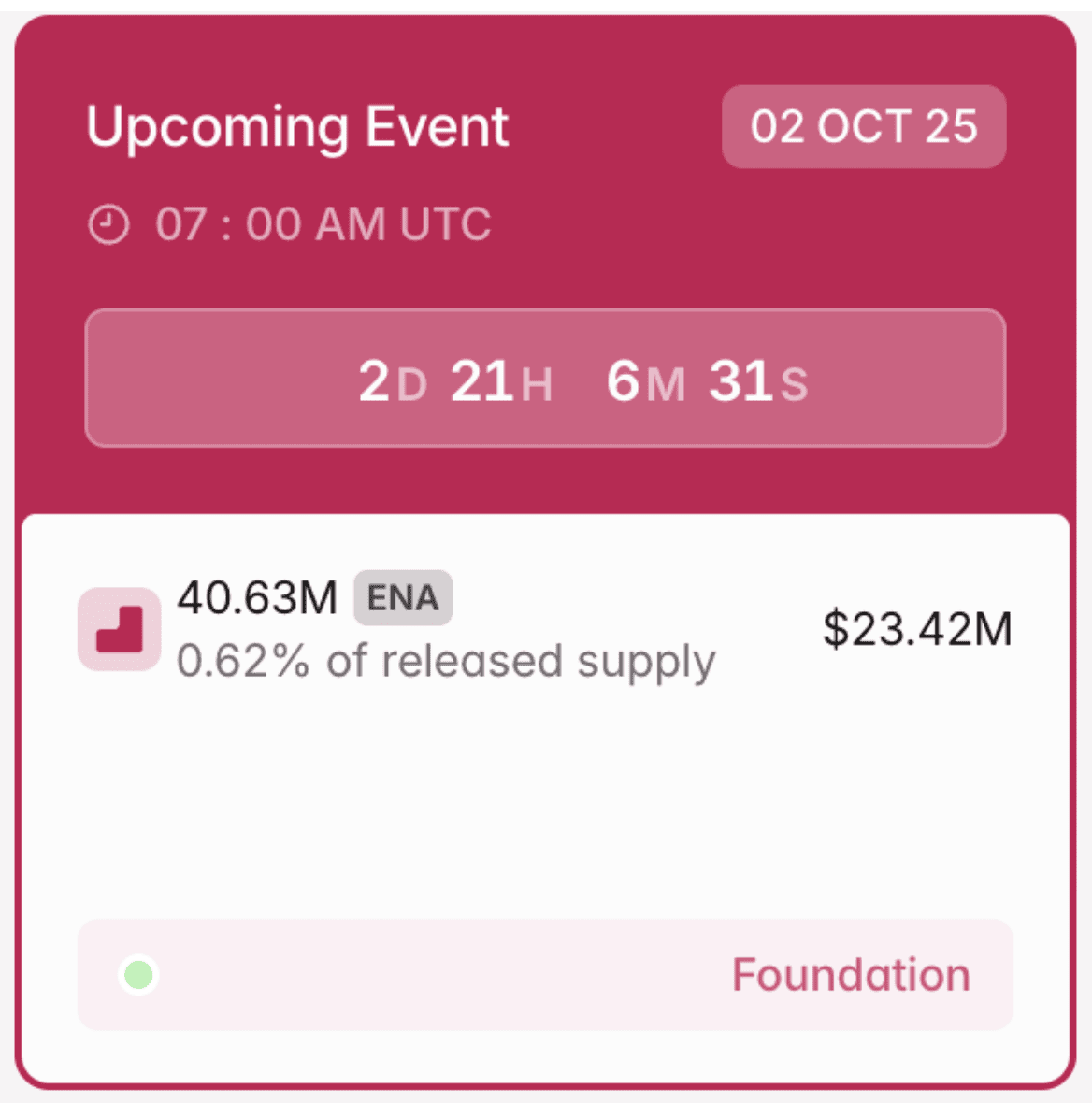

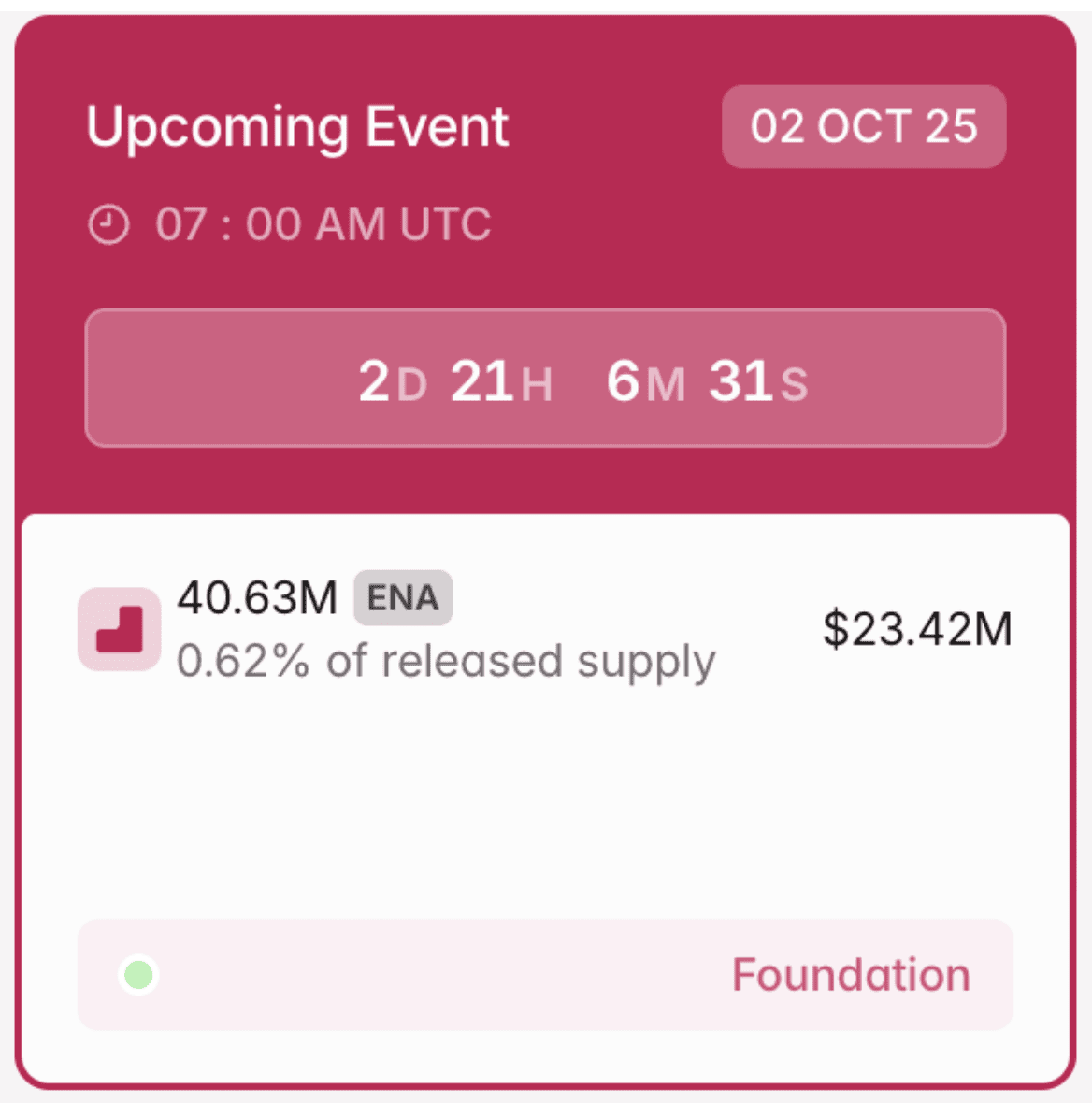

3. Ethena (ENA)

• Unlock Date: October 2, 2025

• Number of Tokens to be Unlocked: 40.63 million ENA (0.27% of Circulating Supply)

• Current Circulating Supply: 6.889 billion ENA

• Total Supply: 15 billion ENA

Ethena, a synthetic dollar protocol built on Ethereum with USDe as its flagship stablecoin, will unlock approximately $23.42M–$51.23M worth of tokens via its cliff vesting schedule, equal to 0.27% of its circulating supply and 0.62% of released supply. The token's price may struggle as traders anticipate new supply. This makes ENA one of the highest-risk events of early October, with liquidity and demand being key factors to watch. Ethena will award the entire unlocked supply of 40.63 million ENA tokens to the Foundation. Current circulating supply stands at 6.889 billion ENA out of 15 billion total.

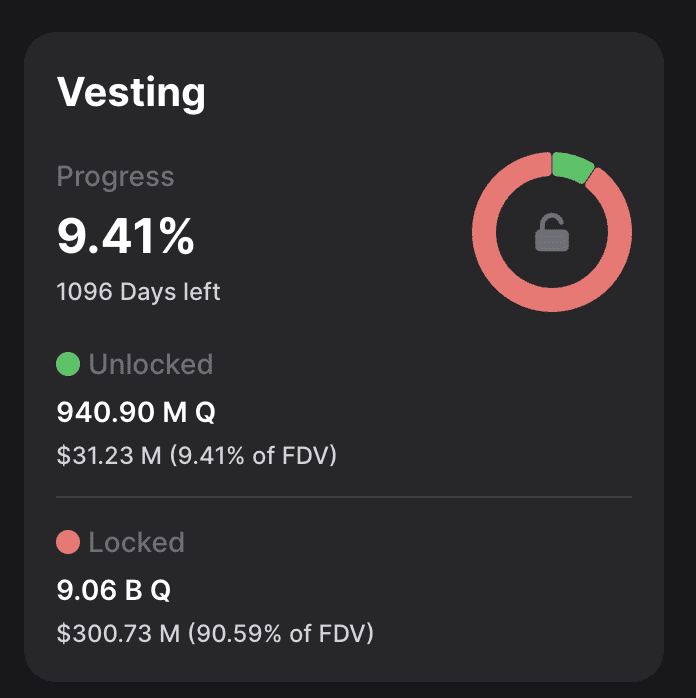

4. Quack AI (Q)

Date: October 2, 2025

Quack AI (Q), an AI-powered governance infrastructure project, will unlock $11.21M worth of tokens, representing a substantial 24.58% of its market cap. This release marks the second tranche of its airdrop vesting schedule, following the initial token generation event in early September. With only 10% of tokens unlocked at launch and the remaining 90% distributed over four monthly releases, this October unlock could introduce significant volatility depending on holder behavior. The token utility centers on staking, governance, and access to premium analytics—making this unlock a key moment for both liquidity and protocol engagement.

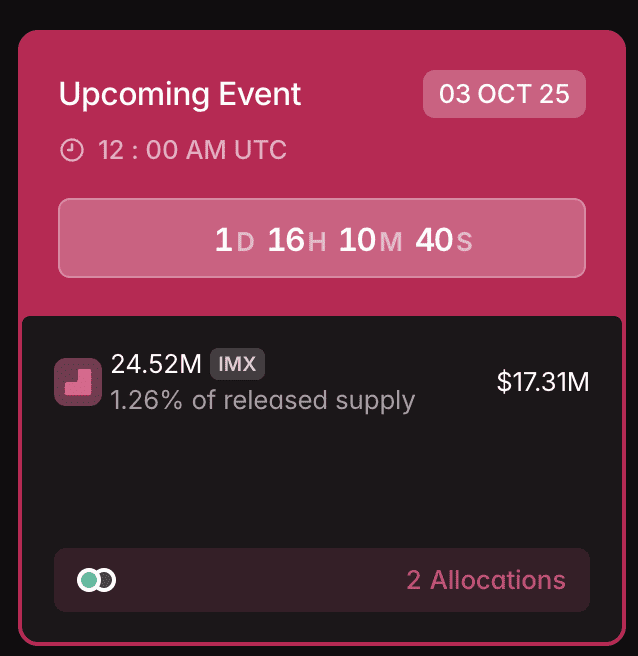

5. Immutable (IMX)

Date: October 3, 2024

Immutable,the

Ethereum Layer-2 gaming and NFT platform, will unlock approximately 12.54 million IMX tokens on Oct 4. Valued at around $8–10M, the event represents about 0.6% of supply and could weigh on short-term liquidity. This release is part of the platform's long-term vesting strategy, with allocations likely tied to ecosystem development, team incentives, and strategic partnerships. Since IMX is heavily tied to GameFi and NFT market sentiment, emissions from this unlock may affect both token price and project ecosystem funding.

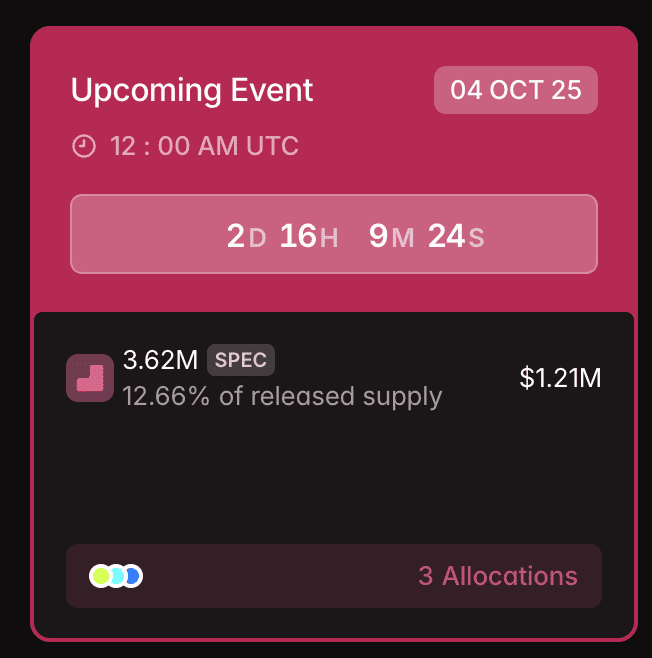

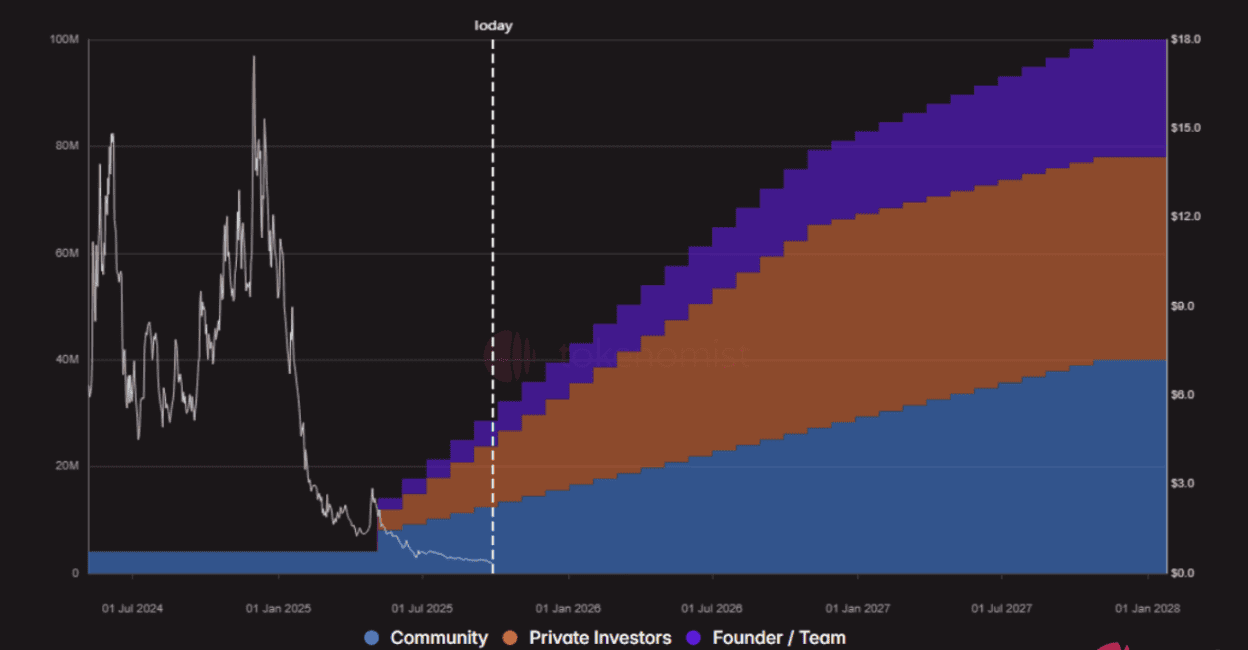

6. Spectral (SPEC)

Date: October 4, 2025

• Unlock Date: October 4, 2025

• Amount: $ 1.25M

• Unlock as % of Circulating Supply: 12.66%

• Vested Allocations: Investors, Community, and Core Contributors

SPEC token unlock schedule

Spectral (SPEC) will unlock $1.25M worth of tokens on Oct 4, representing 12.66% of its circulating supply—the largest relative unlock this week. Vested allocations include investors, community, and core contributors. However, SPEC continues to drift toward new all-time lows as momentum in the AI narrative fades. This unlock could test market appetite further, as investors watch to see whether community allocations support renewed activity or simply add to the existing sell pressure.

Other Token Unlocks in Mid and Late October 2025

1. Aster (ASTER): On Oct 5, Aster will release 320 million tokens worth ~$503–$620M, adding about 19.3% to its circulating supply and testing demand for this project.

2. Pump.fun (PUMP): Scheduled for mid-October,

Pump.fun unlocks ~$54.82M, nearly 3% of supply, which could spark volatility in this memecoin-driven project.

3. LayerZero (ZRO): LayerZero will unlock ~$49.23M in mid-October, representing over 10% of supply, with its cross-chain ecosystem likely sensitive to new emissions.

4. Aptos (APT): On Oct ~15, Aptos will release ~$47.96M in tokens, adding about 1.6% to its circulating supply and testing demand for this layer-1 blockchain.

5. Arbitrum (ARB): Arbitrum's Oct 9 unlock adds ~$37.71M (1.2% of supply) with 11.5 million tokens, primarily for teams, advisors, and the Foundation, making it one of the largest L2 events this month for traders to monitor.

6. Hashflow (HFT): Hashflow faces an unlock on Oct 7 worth 1.7% of its supply, distributed to core contributors and ecosystem growth initiatives, posing moderate supply-side pressure in the cross-chain DEX space.

7. Automata (ATA): Automata will unlock 1.0% of its total supply on Oct 8, including allocations for the team and strategic partners.

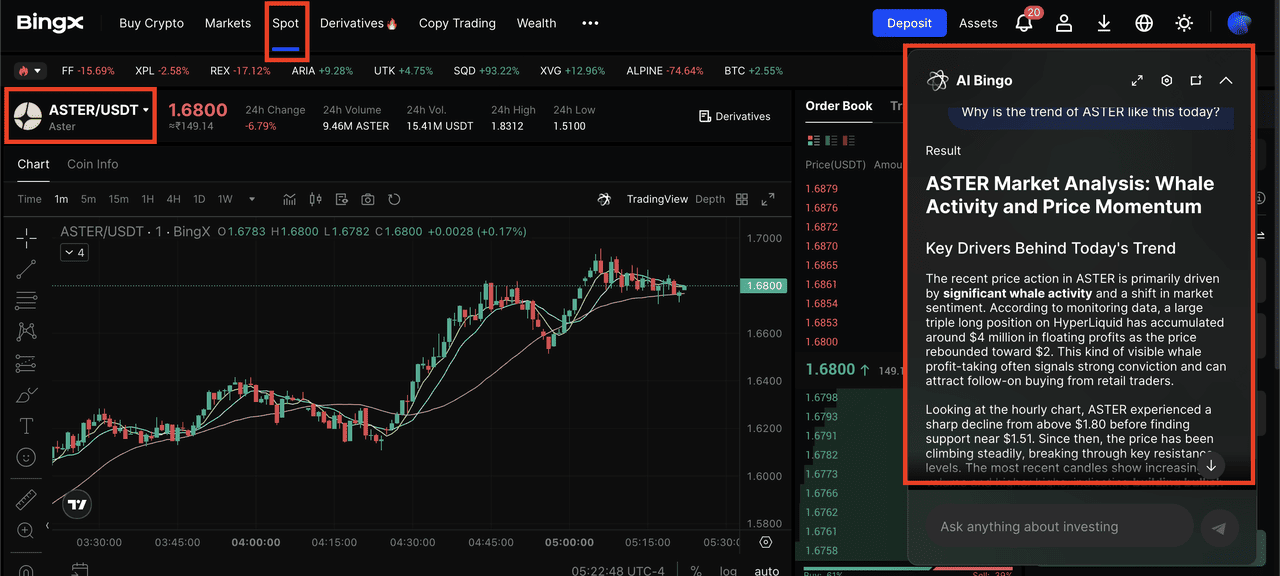

How to Trade Token Unlocks on BingX

ASTER/USDT trading pair on the spot market powered by AI Bingo insights

Token unlocks can create sharp, short-lived opportunities or heavy downside risks. To trade them effectively, you need to prepare ahead of time, track supply dynamics, and use BingX tools to manage execution and risk:

1. Know the clock. Most unlocks drop at 00:00 or 12:00 UTC, so plan your orders and liquidity before the hour to avoid chasing volatile moves.

2. Size vs. float matters. Don’t just look at the dollar value, focus on the % of circulating supply being unlocked. A 2–3% release in a thinly traded token can hit harder than a larger unlock in a deep market.

3. Track recipient type. Tokens going to team or treasury wallets may stay locked longer, while investor or emissions unlocks are more likely to hit the market quickly. Check vesting dashboards like Tokenomist for wallet details.

4. Use BingX tools.

• Spot & Perps: Short into pre-unlock rallies or buy post-dump stabilization depending on order book conditions.

•

BingX AI: Monitor real-time sentiment, order flow, and volatility alerts to avoid entering at the worst levels.

• Risk controls: Mark invalidation levels, e.g., prior day’s VWAP or support, use tight leverage, and set alerts 30–60 minutes before and after unlock windows.

5. Mind narrative risk. If the project has upcoming catalysts (mainnet launch, token listing, or governance upgrade), that bullish momentum can absorb new supply. Always cross-check roadmaps and community updates before trading around unlocks.

6. Execution timing matters.

• Before the hour: Use

BingX AI to gauge stress in the order book and place bracket orders with stops and targets.

• During unlock: Watch 1–5m candles to stop cascades and liquidity absorption; keep sizing small in the first 15 minutes.

• After unlock: If price holds above support with spot demand and cooling perp funding, look for mean-reversion longs. If breakdowns continue with rising open interest and negative CVD, stick to trend-following shorts.

Conclusion

October 2025 is shaping up to be one of the most eventful months for token unlocks, with billions in supply set to hit the market across major projects like Sui, Aster, Ethena, and Arbitrum. While these events can create short-term volatility, they also provide valuable insights into project tokenomics, investor behavior, and overall market resilience. For traders, the key is preparation, including tracking unlock schedules, monitoring liquidity, and using tools like BingX AI to respond in real time. Remember, token unlocks do not guarantee predictable outcomes: some may trigger heavy selling, while others could be absorbed smoothly. Always approach unlock season with sound risk management, limit exposure to oversized positions, and be prepared for unexpected price swings.

Related Reading