Aster (ASTER) is a next-generation decentralized perpetual exchange (Perp DEX) created in late 2024 through the merger of Astherus and

APX Finance. Built to rival giants like

Hyperliquid, Aster combines Astherus’ yield-generating products with APX’s perpetual trading infrastructure to deliver a unified, on-chain trading experience.

The platform offers perpetual contracts, spot trading, yield products, and even 24/7 stock perpetuals, all across multiple chains including BNB Chain, Ethereum, Solana, and Arbitrum. Backed by YZi Labs and supported publicly by CZ, Aster has quickly become one of the most anticipated DeFi launches of 2025.

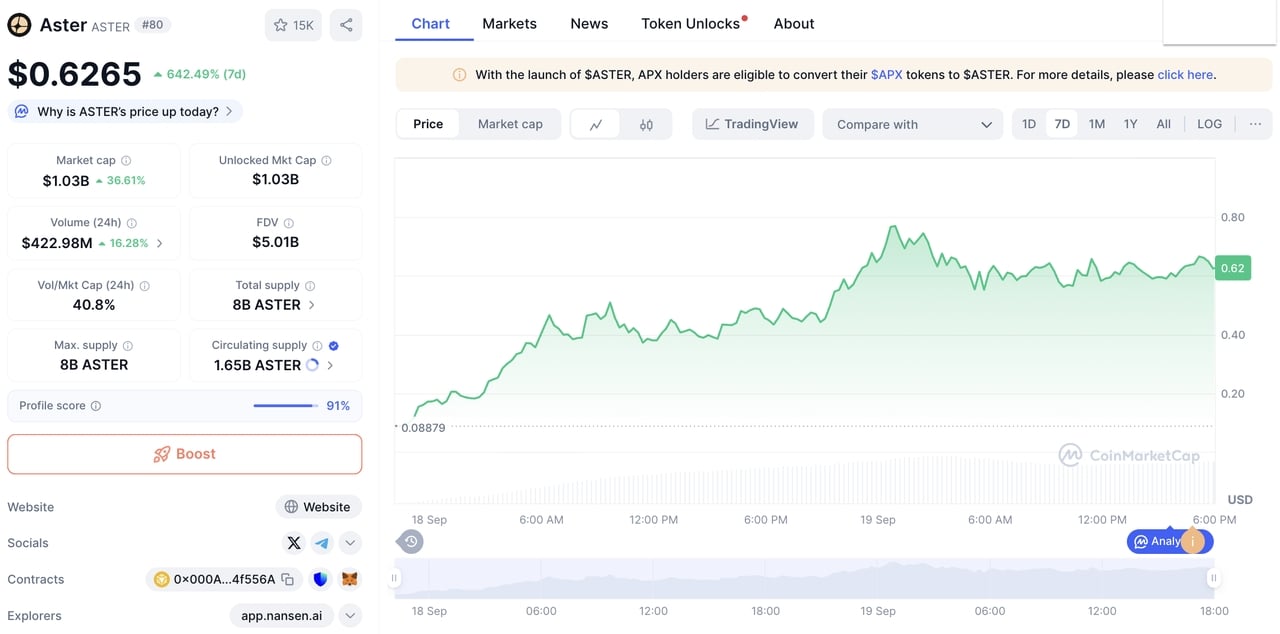

Following its September 17 Token Generation Event (TGE), $ASTER surged from $0.08 to as high as $0.79, reaching a market cap of nearly $1.9 billion in just two days. With its airdrop claim window open until Oct 17, 2025, Aster is drawing unprecedented attention from traders searching for the “next Hyperliquid.”

What Is Aster DEX and How Does It Work?

Aster DEX is a multi-chain

decentralized perpetual exchange that allows users to trade crypto and stock perpetual contracts with deep liquidity and ultra-low fees. After merging Astherus (yield products) and APX Finance (perp trading), Aster delivers a one-stop platform that blends trading, earning, and staking into a seamless on-chain

experience.

The exchange offers four main trading modes:

• Pro Mode: A full order book interface with 0.01% maker / 0.035% taker fees, advanced tools like grid trading and hidden orders, and support for multi-asset margin across

BNB Chain,

Ethereum,

Solana, and

Arbitrum.

• 1001x Mode (Simple): a streamlined, MEV-resistant one-click trading system with leverage up to 1001×, powered by the ALP liquidity pool and oracles from

Pyth,

Chainlink, and Binance Oracle.

• Dumb Mode: a price prediction game for short-term forecasts.

Together, these innovations position Aster as a high-performance, community-first DeFi exchange that directly challenges centralized platforms and leading perp DEXs.

Why Aster Perp DEX Is Getting Attention in 2025?

The decentralized derivatives market has become the fastest-growing sector in

DeFi, and Aster is at the center of this shift. From record-breaking trading volumes to heavyweight endorsements and product breakthroughs, several factors explain why Aster is drawing outsized attention in 2025.

1. Perpetual Market Surges 654%, Aster Hits $408B Cumulative Volume

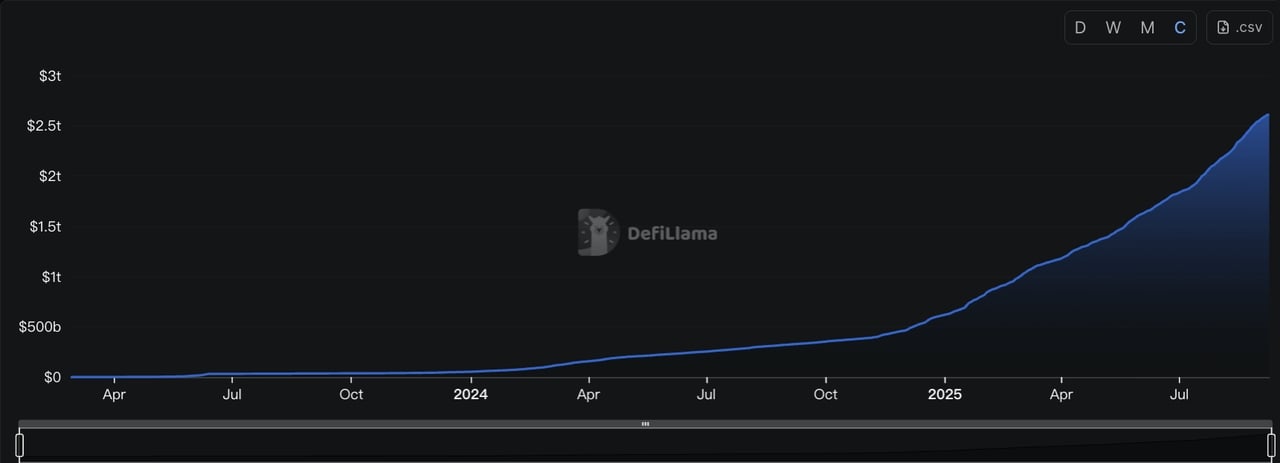

Cumulative trading volume on Hyperliquid perps has reached a mind-boggling $2.5T | Source: DefiLlama

The DeFi derivatives sector soared 654% year-on-year, reaching nearly 18.9 billion dollars in market cap by late August 2025, with perpetuals accounting for more than 17.9 billion.

Hyperliquid (HYPE) still dominates with 70–80% market share and over 350 billion dollars in monthly volume, but challengers like

MYX Finance (MYX) and Aster are making their mark. Aster’s offering of 24/7 stock perpetuals and 1001x leverage has already helped it surpass 408 billion dollars in cumulative volume, positioning it as one of the most formidable rising competitors.

2. $ASTER Skyrockets 875% After TGE With CZ’s Endorsement

Aster’s momentum isn’t just about numbers. It is incubated by YZi Labs and received a high-profile nod from Binance founder CZ, who publicly shared ASTER’s chart after launch. This endorsement fueled trading excitement, contributing to the token’s meteoric rise: following its September 17 Token Generation Event (TGE), $ASTER surged from 0.08 dollars to 0.79 dollars within two days, pushing its market cap from just 40 million dollars (APX) to nearly 1.9 billion dollars.

3. Pro Mode, 1001x Mode, and Stock Perps Redefine the DEX Experience

Beyond hype, Aster differentiates itself through product innovation. Pro Mode offers a deep-liquidity order book with multi-asset margin and advanced tools like grid trading and hidden orders. The hidden order function lets traders conceal large positions until execution, reducing market impact and providing functionality similar to a dark pool. Meanwhile, 1001x Mode delivers MEV-resistant, one-click leverage up to 1001x, making it easy for users to access extreme leverage transparently on-chain. On top of crypto perpetuals, Aster introduced stock perpetuals, bridging TradFi exposure with decentralized trading. Coupled with yield products like asBNB and USDF, Aster creates a capital-efficient ecosystem that blends trading, earning, and collateral flexibility.

What Is the ASTER Tokenomics?

$ASTER Token Utilities

ASTER is the core asset of the Aster ecosystem. It supports governance participation, rewards traders and liquidity providers, incentivizes community engagement, and channels protocol revenue into buybacks that benefit long-term holders. The token anchors ecosystem stability and ensures users share in Aster’s growth.

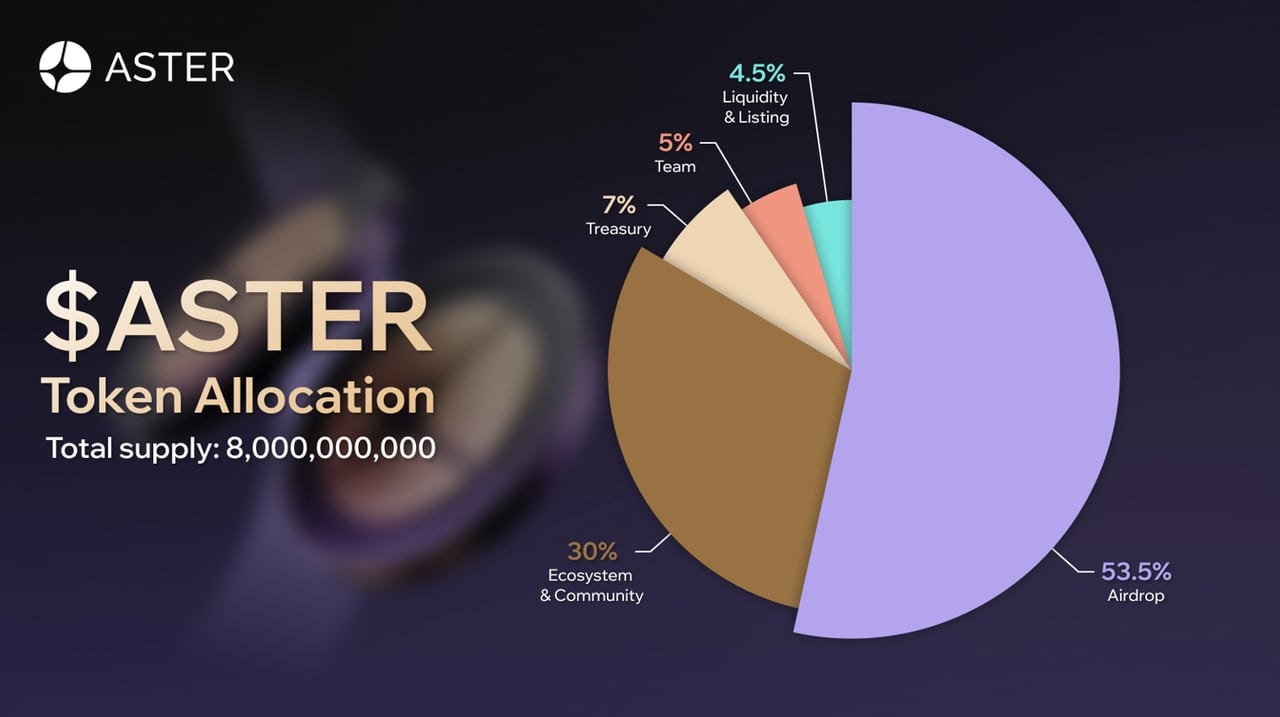

$ASTER Token Allocation

• Total supply: 8,000,000,000 ASTER

• Airdrop: 53.5% or 4.28 billion tokens for community rewards and incentives.

• Ecosystem and Community: 30% or 2.4 billion tokens for migration, grants, marketing, and liquidity.

• Treasury: 7% or 560 million tokens for growth initiatives and reserves.

• Team: 5% or 400 million tokens with a one-year cliff and 40-month vesting.

• Liquidity and Listings: 4.5% or 360 million tokens to support exchange listings and liquidity.

At the Token Generation Event on September 17, 2025, 704 million ASTER (8.8% of supply) was unlocked for eligible users, with the remainder distributed gradually through vesting and rewards.

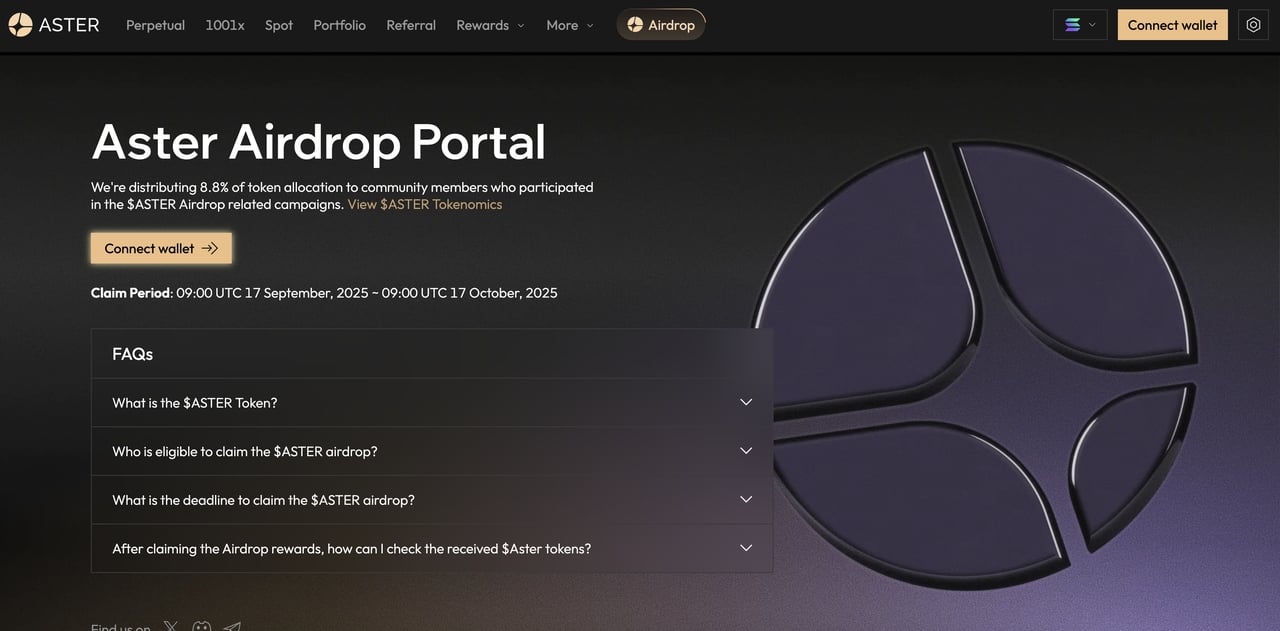

$ASTER Tokens Airdrop: Key Dates and How to Claim ASTER

Key Dates:

• TGE Unlock: 704 million ASTER (8.8% of supply) on September 17, 2025.

• Claim Window: Open from September 17 to October 17, 2025.

• Unclaimed Tokens: Redirected to the community rewards pool after October 17.

Eligibility:

• Participants who earned Rh or Au points in Aster Spectra Stage 0 and 1.

• Users who received Aster Gems from community or partner initiatives.

• Traders who used Aster Pro after Stage 1 and earned loyalty rewards.

Claim Process:

2. From September 17, click “Claim” to receive ASTER directly into your Aster Spot account.

3. No wallet approval or gas fees are required; beware of phishing sites that ask for authorization.

How to Trade $ASTER on BingX?

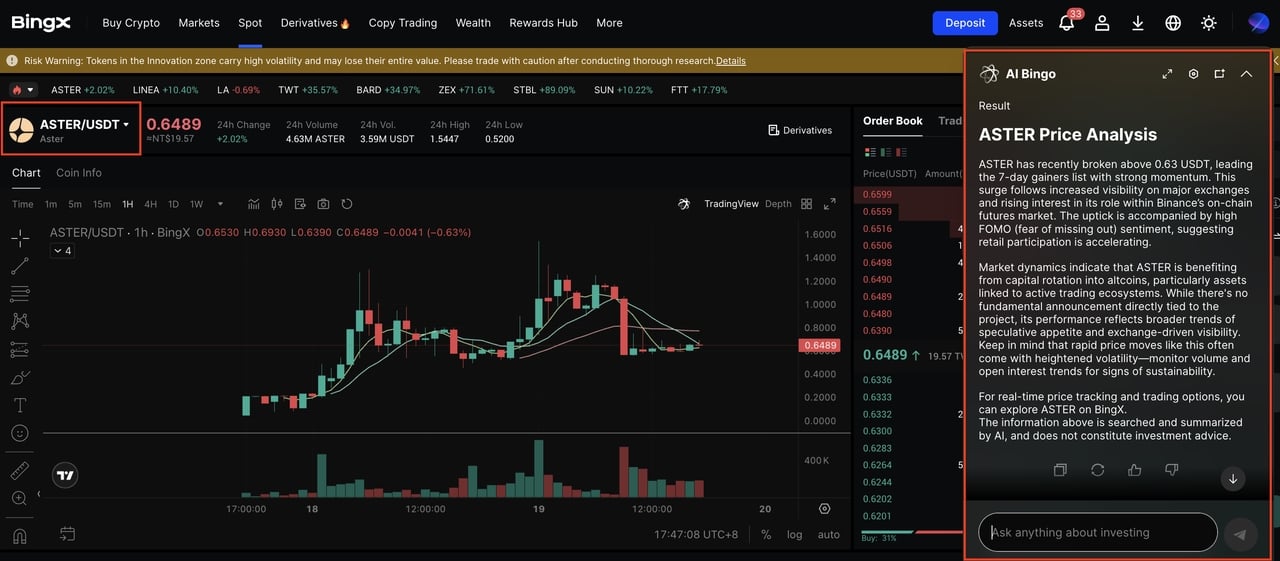

Aster is one of the most anticipated perpetual protocol launches of 2025, and BingX makes it simple to trade $ASTER through both spot and futures markets. With BingX AI providing real-time insights, traders can make more informed decisions whether building long-term positions or trading short-term volatility.

Step 1: Find Your Trading Pair

Step 2: Analyze with BingX AI

Click the AI icon on the trading page to access

BingX AI. The tool highlights price trends, support and resistance levels, and market signals, helping you evaluate entry and exit points more effectively.

Step 3: Execute and Monitor Your Trade

Place a market order for instant execution or a limit order at your desired price. Keep monitoring BingX AI for updates as market conditions change, and adjust your position accordingly.

With BingX and BingX AI, trading $ASTER becomes more accessible and data-driven, whether you are building a long-term position or taking advantage of short-term volatility.

Risk and Consideration Before Using Aster DEX Platform

Like all DeFi platforms, Aster comes with opportunities and risks. Traders should carefully evaluate the following points before committing funds:

1. Token volatility: Newly launched tokens with large airdrops often face heavy selling pressure, causing sharp price swings.

2. Liquidity depth: Some trading pairs may still lack deep liquidity, leading to slippage on larger orders.

3. Leverage exposure: Using leverage up to 1001x can quickly trigger liquidation if the market moves against you.

4. Smart contract risk: As a new protocol with complex features, Aster remains vulnerable to potential exploits or technical failures.

5. Airdrop pitfalls: Claiming ASTER requires no approvals or gas fees; any site asking otherwise is likely a phishing scam. Claims must also be made within the 30-day window.

Final Thoughts: What's Next for Aster

Aster has already made a strong debut with its record-breaking TGE and rapid trading growth, but the project’s ambitions extend far beyond its current features. The roadmap points to a deeper evolution of the platform.

The team is building Aster Chain, a high-performance Layer 1 designed to support privacy through zero-knowledge proofs and enable smoother execution with an intent-based trading system that can automate orders across multiple chains and liquidity sources. These upgrades aim to make Aster not only a trading venue but also a foundational layer for decentralized derivatives.

If delivered, these milestones could transform Aster into one of the most complete infrastructures in DeFi, blending advanced perp trading with scalable on-chain automation. For now, the airdrop and trading momentum have cemented its place as a rising challenger, while the roadmap suggests that the most significant growth may still be ahead.

Related Reading