Lombard is a Bitcoin DeFi Protocol launched in 2024 that lets you stake BTC to mint yield-bearing LBTC and use BARD staking for security and product access, building the rails for Bitcoin to move and earn onchain. The team’s core belief is that finance advances when common standards exist: SWIFT for cross-border payments, venues like CME for commodities, and stablecoins for fiat liquidity in crypto. Lombard applies the same playbook to Bitcoin by delivering middleware and infrastructure that make BTC easy to plug into

DeFi.

At the heart of this stack sits LBTC, a transferable, yield-bearing representation of Bitcoin that is fully backed by native Bitcoin reserves. As of September 18, 2025, LBTC counts about 260,000 users worldwide and a Total Value Locked (

TVL) around 1.5 billion USD.

What Is Lombard (BARD) and How Does it Work?

Lombard (BARD) makes Bitcoin usable onchain without changing BTC’s base rules. At its core is LBTC, a fully BTC-backed token whose BTC value per unit rises over time as yield accrues in native BTC. This turns Bitcoin idle into productive capital for DeFi.

The paradox: Bitcoin barely participates in the onchain revolution it sparked. Most Bitcoin (BTC) sits idle in cold wallets. This leaves the base layer of Bitcoin isolated from other chains and innovation around it lags, resulting in trillions of dollars of unrealised opportunity. As BTC stays idle, the digital economy that should be built around Bitcoin remains dormant.

The usable "money" side is represented by LBTC, which is a transferable claim on native BTC for DeFi and cross-chain use. BARD, on the other hand, is the governance and incentives token that establishes the rules and aligns the operators. It is not a claim on BTC. LBTC is fully backed 1:1 by native BTC and redeemable for BTC; yield flows into reserves and lifts the exchange rate (BTC per LBTC) over time. BARD is not backed by BTC and has no redemption; any value comes from governance rights and fee routing decided by the protocol. LBTC moves via mint/burn so supply matches audited BTC reserves across chains. BARD steers policies (fees, risk limits, validator/consortium sets) and can be used to incentivize secure cross-chain operations.

How to Stake LBTC on the Lombard Network

LBTC lets you keep core BTC exposure while putting Bitcoin to work onchain. You deposit Bitcoin to a unique address, receive LBTC, and can use it across DeFi while yield accrues in native BTC. You can redeem back to native Bitcoin onchain with a typical 7 to 9 day settlement window for predictable liquidity.

• Wallet & prep: Hold BTC in a self-custody or exchange wallet that can send to your unique Lombard deposit address. Check network fees; consider a small test send for large transfers.

• Deposit → receive LBTC: Generate your personal BTC address in the Lombard app, send BTC, and receive LBTC after confirmations. You’ll get fewer LBTC units than BTC units, but the value matches because each LBTC represents more BTC over time.

• Use LBTC in DeFi: LBTC can be used as collateral, in liquidity pools or in strategies, and is freely transferable. Support for integration varies by protocol.

• Yield & APY: Project reports a trailing 14-day APY of 0.83% paid in native BTC. APY varies with revenue sources, market conditions, and validator performance. Monitor official dashboards for updates.

• Unstake/redeem: Start onchain redemption anytime; settlement typically takes 7–9 days, after which native BTC is returned. Secondary markets may offer faster exits but can trade at a deviation from redemption value.

• Fees & audits: Small minting fee applies only when minting on

Ethereum, a fixed network fee applies on redemption, and a performance fee applies to rewards. Lombard cites multiple audits (e.g., OpenZeppelin, Veridise), but residual risk remains.

BARD Tokeonomics: Utilities and Token Allocation

BARD Token Utilities

$BARD is the coordination layer for Lombard. It gives holders a direct say in protocol decisions, helps secure cross-chain LBTC movement, and funds growth so Bitcoin can work onchain at scale.

• Governance: Shape validator sets, fees, product roadmap, and LBF grant allocations through onchain voting.

• Security: Stake $BARD to help secure LBTC transfers built on Chainlink CCIP and Symbiotic, adding a decentralized protection layer that scales with usage.

• Ecosystem Development: Direct resources via the Liquid Bitcoin Foundation to grants, partnerships, and R&D that drive LBTC adoption and real-world integrations.

• Protocol Utility: Access and enhance Lombard products with priority access, preferred terms, and expanding features defined by governance.

BARD Token Allocation & Revenue

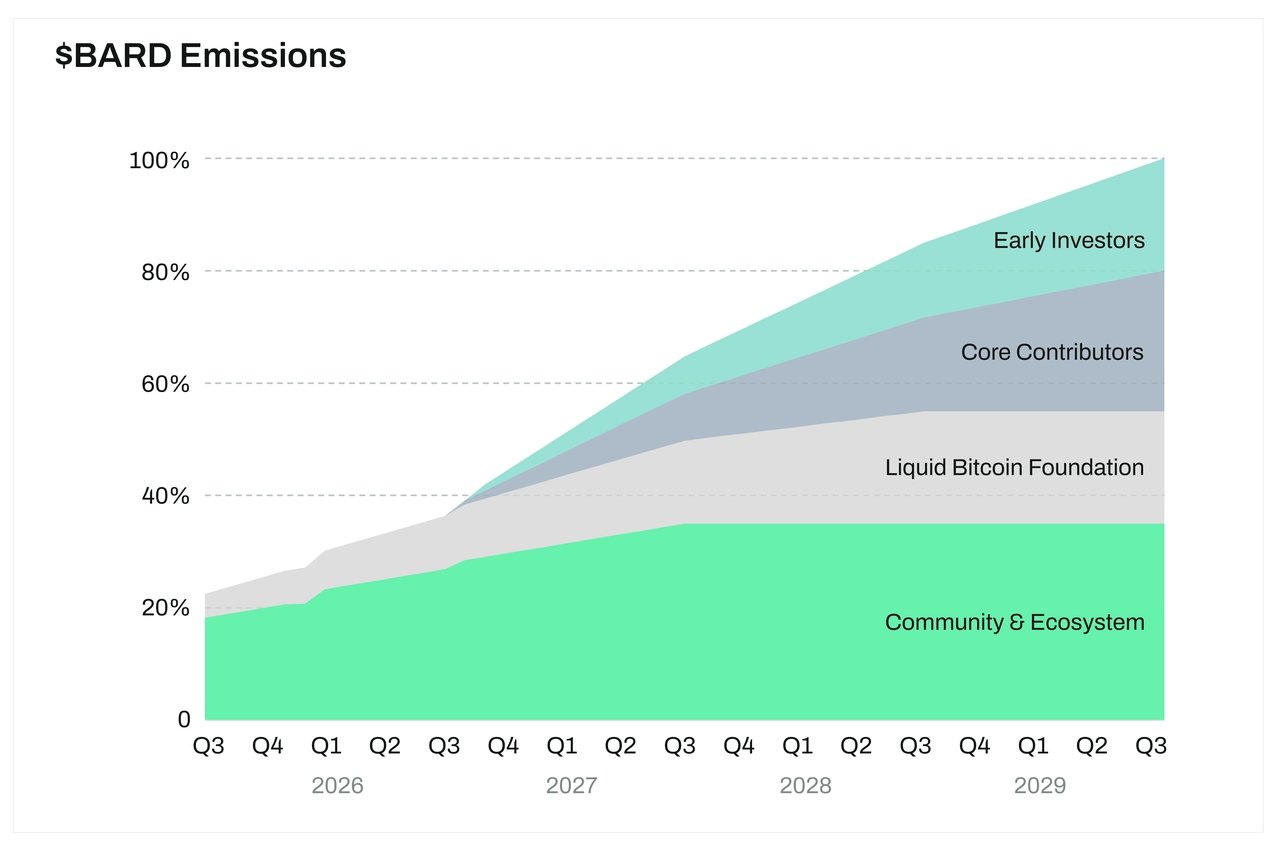

BARD has a fixed total supply of 1,000,000,000 at TGE. Of that, 22.5% enter circulation at launch, with the remainder unlocking over 48 months to align long-term incentives for team, investors, and the Community. A large share funds ecosystem growth, while the Liquid Bitcoin Foundation (LBF) acts as protocol steward for research, partnerships, and core infrastructure. Revenue today comes mainly from LBTC staking on Babylon and vault fees, with additional lines expected from potential mint/redeem fees, the Lombard Ledger, the Lombard SDK, and a planned buyback program. There is no direct revenue share to the token unless governance implements the buyback mechanism.

Supply: 1,000,000,000 total; 22.5% circulating at TGE; remaining unlocks over 48 months

Allocation: Ecosystem 35%, Liquid Bitcoin Foundation 20% (TGE + 3 years linear), Early Investors 20% (12-month cliff, 48-month linear), Core Contributors 25% (service-based, unlocks from month 12)

Revenue

• LBTC staking yield: fee share from operating finality providers on Babylon

• Vaults: management fees and potential performance fees

• Lombard Ledger: Proof-of-Authority settlement layer with prospective transaction fees

• Lombard SDK: already integrated by major exchanges, enabling possible revenue sharing

• Permissionless BTC wrapper: planned, yieldless wrapper for trading use cases

• Buyback program: planned mechanism to tie protocol fees more directly to stakers

$BARD Supply Emissions | Source: Lombard.Finance

When to Claim BARD Airdrop

Claim Event 1 (TGE): Opens on September 18, 2025 (TGE/listing day). Claim window lasts 90 days.

Claim Event 2 (+6 months): Opens around March 18, 2026, with another 90-day claim window.

How to Trade Lombard (BARD) on BingX

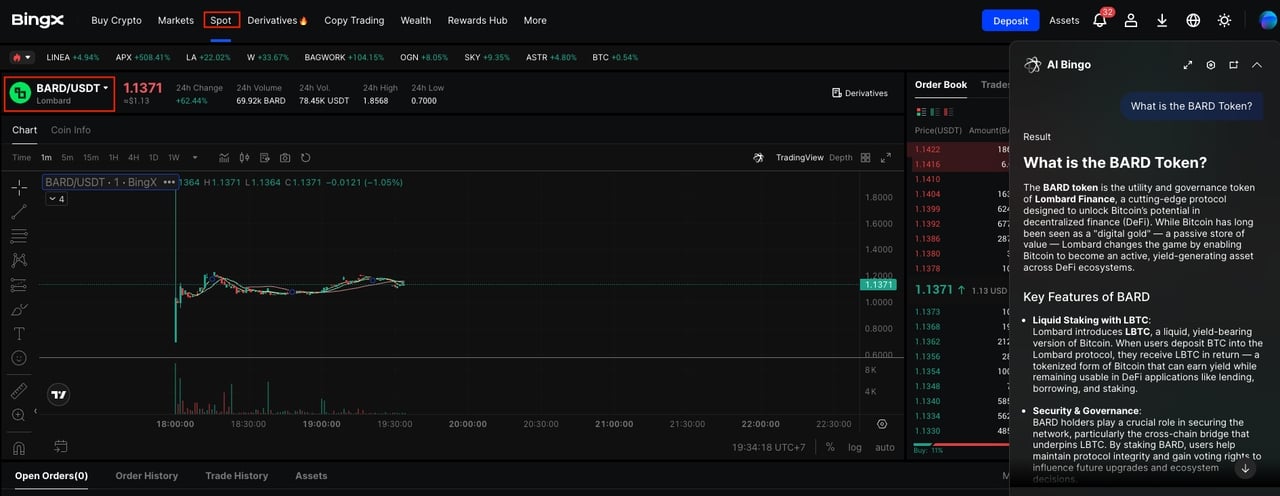

BARD/USDT trading pair on the spot market, powered by BingX AI | Source: BingX

If you get BARD via airdrop, a community sale, or a secondary marketplace, you can trade it on BingX’s Spot Market. BingX is accessible for newcomers and also offers advanced, real-time BingX AI insights to guide entries and exits.

Key listing info:

The BARD/USDT trading pair officially went live on September 18, 2025, at 11:00 UTC. . The pair launched on the ERC20 network, giving users access through Ethereum-compatible wallets and infrastructure.

Step 1: Open and verify your account

Register by email or phone, then complete

KYC verification to access full trading features, higher withdrawal limits, and stronger security.

Step 2: Fund with BARD or USDT

Head to your BingX wallet and deposit BARD if you already hold it, or add

USDT to purchase BARD. Always select the correct network before sending funds.

Step 3: Locate the BARD/USDT market

In the

Spot section, search for

BARD/USDT. This is the core pair for buying and selling BARD against USDT.

Step 4: Choose your order type

Use a

Market Order for immediate execution at the current price. Use a

Limit Order to set your own price and wait for the market to reach it.

Practical tip

Start small, set

Take-Profit and Stop-Loss levels to manage risk, and use BingX AI to track short-term momentum alongside broader trend direction.

Conclusion: What makes Lombard different from other BTC staking models?

Lombard is different because it isn’t a lending scheme. LBTC is fully backed by real BTC, and a simple exchange rate makes each LBTC represent more BTC over time as yield is paid in Bitcoin. That yield comes from on-chain security work (for example, helping secure other networks) instead of risky off-chain borrowing. Reserves are held by a group of institutions and movements between chains are verified, so supply stays aligned with backing. You can always redeem back to native Bitcoin, which anchors the value and avoids the hidden credit risk many other “Bitcoin staking” models carry.

Related Reading