In September 2025,

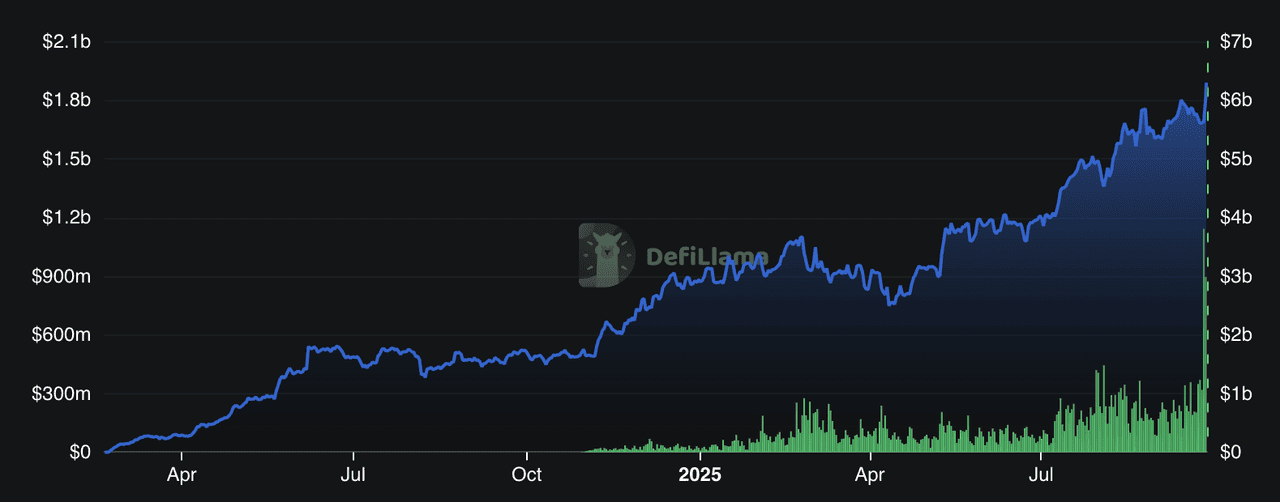

Fluid (FLUID) has emerged as one of the fastest-growing DeFi systems: its total value locked (TVL) has surged beyond $1.8 billion and it has processed over $24 billion in DEX volume in the last 30 days. Yet, for many newcomers, the combination of lending, borrowing, and liquidity is still a bit abstract. Fluid goes beyond being another yield protocol, aiming to unify liquidity across all its modules so capital doesn’t sit idle in one corner of DeFi.

Fluid TVL and DEX volume | Source: DefiLlama

This article unpacks how Fluid works, what makes it unique, real metrics to watch, and how users (even novices) can engage confidently.

What Is Fluid (FLUID)?

Fluid (FLUID), formerly known as Instadapp, is a next-generation DeFi protocol that merges three critical pillars, lending, borrowing through vaults, and trading via its DEX, into one composable system. Instead of siloed liquidity pools for each function, Fluid is built on a shared Liquidity Layer, ensuring that capital can move seamlessly across different modules without being locked in isolated markets.

This unified design improves efficiency and reduces fragmentation in DeFi. By letting collateral or even borrowed assets act as active liquidity in trading pools, Fluid maximizes capital productivity in ways traditional protocols cannot. Its architecture has already been deployed on major chains like

Ethereum,

Arbitrum, Base, and

Polygon, with plans for broader expansion.

As of September 2025, Fluid has grown into one of the most significant liquidity hubs in DeFi, with a TVL of nearly $1.9 billion, DEX trading volume of over $24 billion in the past 30 days, and a market cap of over $525 million. The FLUID token has a circulating supply of roughly 76.8 million out of 100 million max, underscoring both its adoption momentum and future unlock potential.

Why Did Instadapp Rebrand to Fluid?

Fluid officially rebranded from Instadapp in December 2024, when a governance proposal was submitted on December 3 to rename $INST to $FLUID at a 1:1 swap and restructure tokenomics and governance. Beyond a name change, this shift marked the transition from being a DeFi middleware optimizer to positioning itself as a unified liquidity infrastructure powering lending, borrowing, and trading in a single coherent system.

How Fluid Decentralized Exchange(DEX) Works: Core Building Blocks

Here’s a more detailed breakdown of how Fluid’s systems interconnect:

1. Liquidity Layer, the Backbone of Fluid

At the core of Fluid is the Liquidity Layer, a shared pool of assets where users deposit tokens like

ETH,

USDC, or

USDT. These assets are simultaneously available for lending, borrowing, or trading, which prevents liquidity fragmentation across functions. To protect stability, the protocol uses automated ceilings and dynamic limits that gradually raise or restrict borrowing and withdrawals, ensuring controlled growth and minimizing sudden shocks.

2. Lending Market

Fluid’s lending system allows depositors to supply assets and earn interest while borrowers tap into the same pool. Since all deposits are tied directly to the shared liquidity layer, funds don’t need to be shifted across protocols. The system is also ERC-4626 compliant, which standardizes yield-bearing tokens and makes Fluid easier to integrate with other DeFi applications.

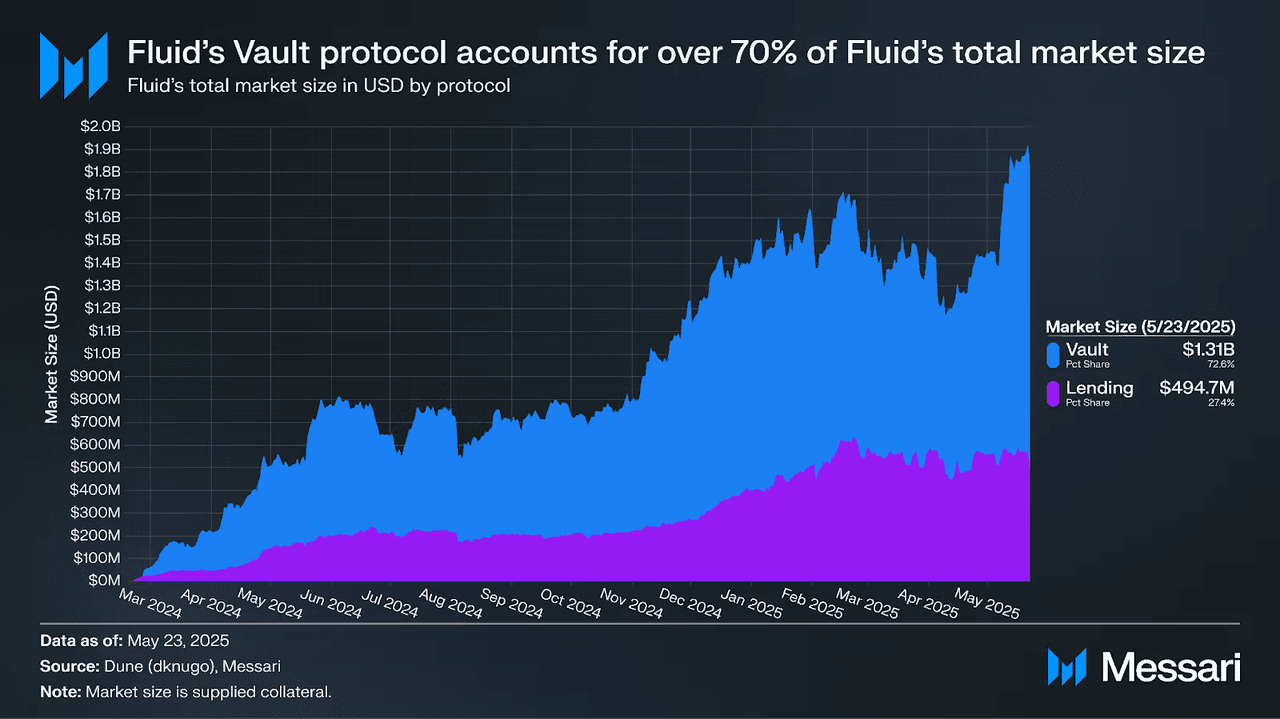

Fluid vaults accounted for 70% of Fluid's market size in May 2025 | Source: May 2025

3. Vaults for Borrowing and Collateral Dynamics

Vaults let users borrow assets against deposited collateral but with a twist: collateral can be used as Smart Collateral, earning fees in DEX pools, while borrowed funds become Smart Debt, also generating fees to offset interest costs. This dual utility makes capital highly efficient. Fluid’s range-based liquidation engine, inspired by

Uniswap v3 tick logic, improves gas efficiency and reduces penalties, allowing safe loan-to-value ratios up to 95% with minimal liquidation losses.

4. DEX and Pool Logic: Fluid's Trading Layer

Fluid’s DEX is fully integrated with the liquidity and vault layers, so liquidity naturally flows into trading without requiring separate pools. In April 2025, Fluid launched DEX v2, enabling modular pool design, custom fee models, on-chain limit orders, hooks for automated strategies, and gas-efficient flash accounting. The platform supports specialized pool types, including Smart Collateral, Smart Debt, and range-based variations, which enhance both trading flexibility and liquidity efficiency.

What Sets Fluid Apart From Other DEXs?

Unified liquidity, not just swaps.

Most DEXs only match trades; Fluid fuses a DEX with lending and vaults on a single Liquidity Layer. That means collateral and even borrowed assets can be reused as active liquidity (Smart Collateral & Smart Debt), so capital earns trading fees while it’s posted as margin or drawn as debt. Pair that with a range-based, batch liquidation engine (higher safe LTVs, tiny penalties), dynamic ceilings that throttle risk, and a modular DEX v2 design (hooks, dynamic fees, custom pool math), and you get a venue where trading, borrowing, and liquidity provision are one continuous system, far less idle capital, far less fragmentation.

Composability for builders, convenience for users.

Developers can spin up custom markets that inherit lending, oracles, liquidations, and fee logic from the stack instead of rebuilding them. For users, this shows up as practical wins: borrow costs that can be offset by DEX fees, sometimes net-positive “paid to borrow,” collateral that works twice, and fewer bridge/migration hops when strategies evolve. In short: Fluid is designed to compound utility from the same dollars, not simply route orders.

Fluid vs. Hyperliquid Perps-First L1

Hyperliquid is a purpose-built L1 for ultra-fast, gas-free perpetuals with a fully on-chain order book; think CEX-style execution in DeFi. Fluid, by contrast, is AMM-based spot/trading tightly integrated with money markets. Where Hyperliquid optimizes speed, order types, and leverage for derivatives traders, Fluid optimizes capital efficiency across products: your vault collateral and your borrowed leg can both become DEX liquidity, with fees reducing borrow APRs and a liquidation engine designed for tiny penalties and batched safety. If you want the deepest on-chain perps experience, Hyperliquid shines; if you want one stack where lending ↔ borrowing ↔ spot liquidity reinforce each other, Fluid is the differentiator.

Fluid vs. Aster Multichain Perps and Yield

Aster blends perpetuals, spot, and yield across multiple chains, offering high leverage, hidden orders, and yield-bearing collateral. Fluid takes a different tack: it’s single-stack unification, the DEX, vaults, and lending

share one Liquidity Layer so positions natively feed each other (Smart Collateral/Debt) and risk controls (automated ceilings, range liquidations) live at the base. Aster appeals to traders seeking perps features and multichain reach; Fluid appeals to users and builders who want one pool to do it all, supply, borrow, and provide liquidity, so the same capital works harder with fewer moving parts.

What Is FLUID Token Utility and Tokenomics?

The FLUID token underpins governance, incentives, and liquidity alignment across the protocol. Token holders can vote on key governance proposals, including fee structures, integration priorities, and risk parameters through the Fluid DAO. FLUID also acts as the coordination asset for liquidity incentives, rewarding both depositors and borrowers who actively contribute to the system’s health.

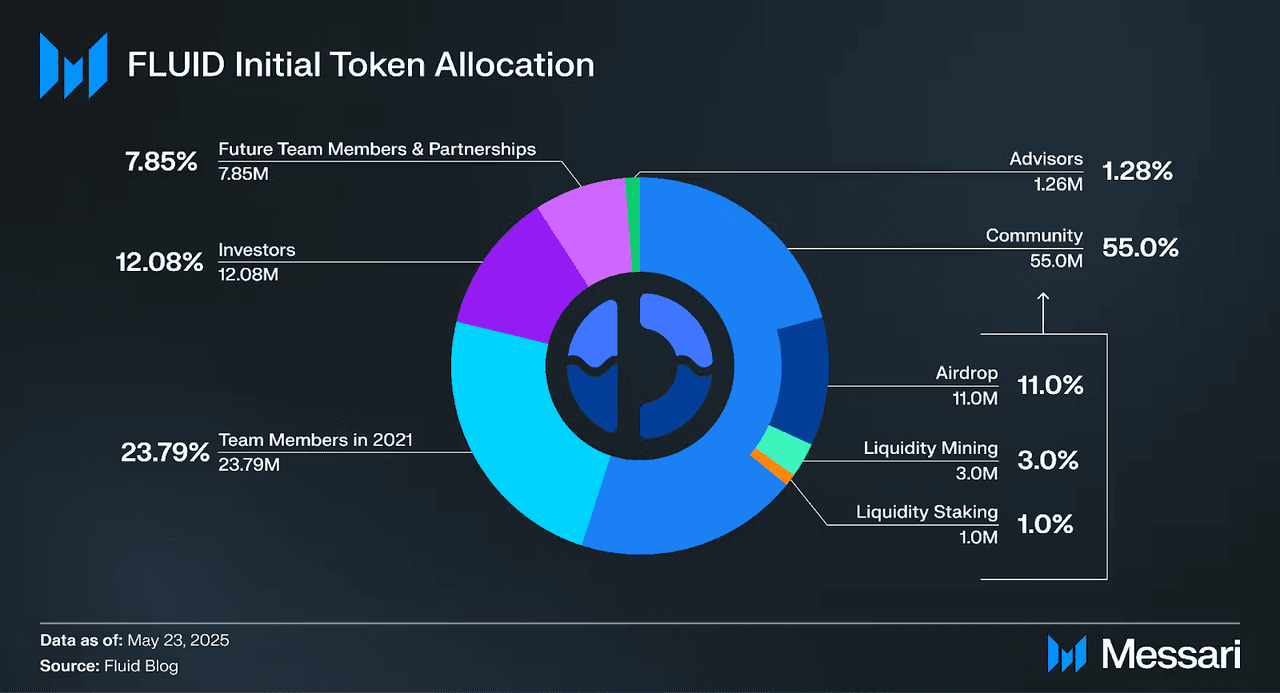

FLUID Token Allocation

FLUID token distribution | Source: Messari

From a tokenomics perspective, FLUID was launched in December 2024 as part of Instadapp’s rebrand. The token has a fixed supply of 100 million, with allocations designed to balance governance, growth, and long-term alignment:

• Community – 55.0%, 55 million

- Includes Airdrop (11.0%), Liquidity Mining (3.0%), and Liquidity Staking (1.0%).

• Team Members in 2021 – 23.79%, 23.79 million

• Future Team Members & Partnerships – 7.85%, 7.85 million

• Investors – 12.08%, 12.08 million

• Advisors – 1.28%, 1.26 million

This structure places a majority of supply in the hands of the community, while vesting schedules and emission controls aim to reduce supply shocks. Combined with its governance role and liquidity rewards, FLUID is designed to be both a utility and value-capture asset within the ecosystem.

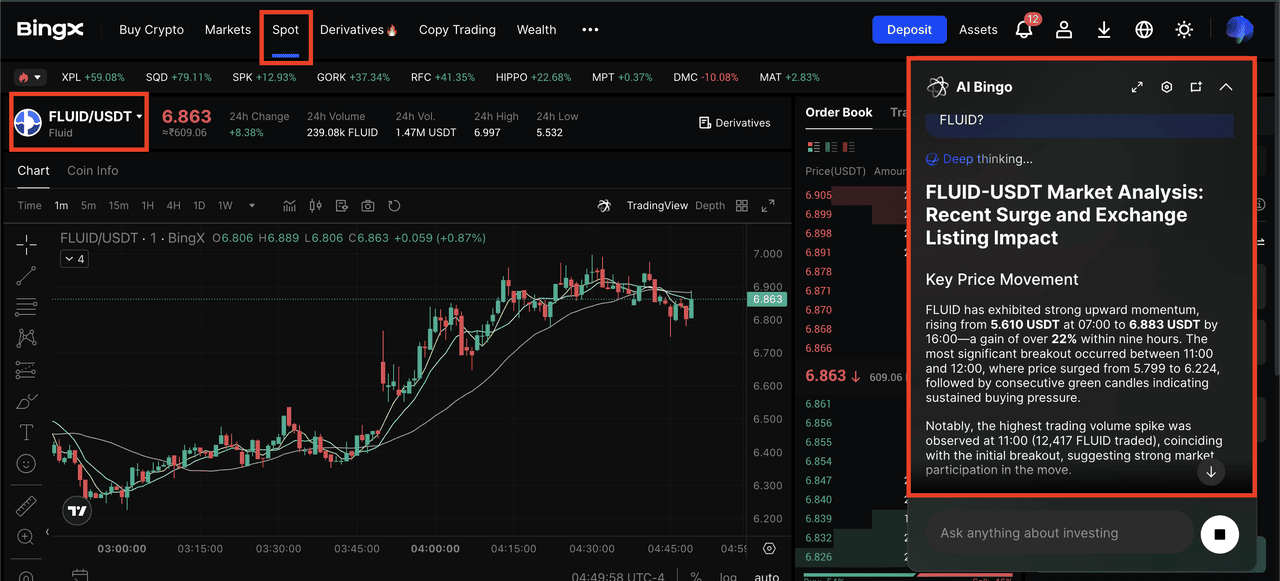

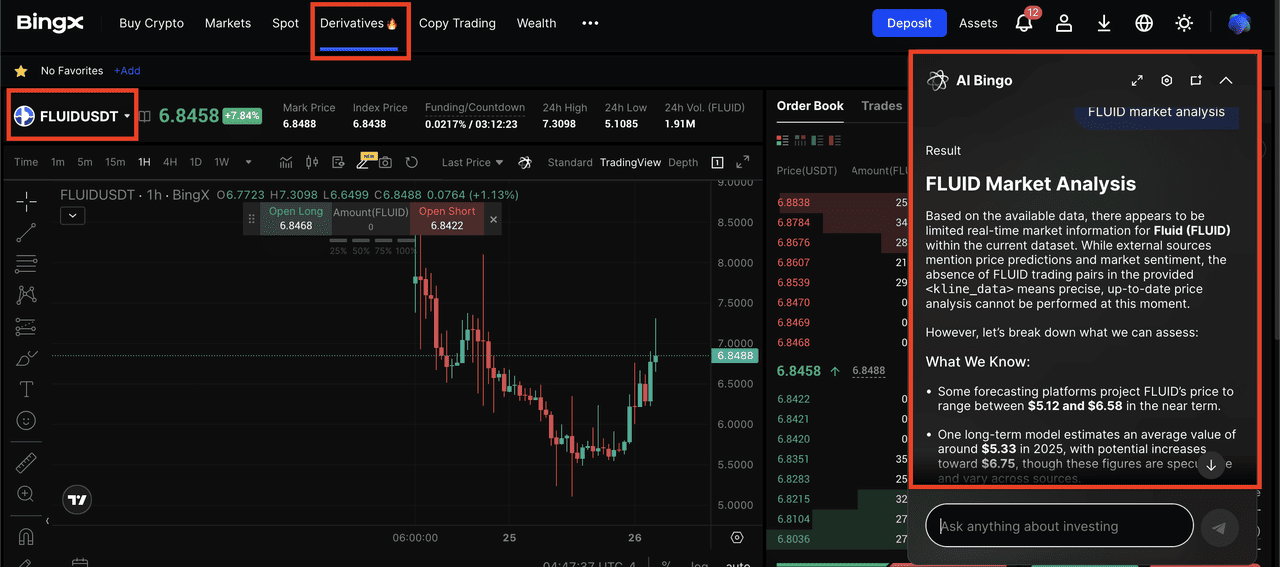

How to Trade FLUID on BingX

BingX makes it simple to trade FLUID across both Spot and Futures markets, with

BingX AI providing real-time insights, price levels, and strategy signals to support smarter decisions.

1. Buy and Sell FLUID on Spot Trading

FLUID/USDT on the spot market powered by AI Bingo insights

Spot trading is best suited for beginners or long-term holders who want direct exposure to FLUID without leverage. On the Spot market, you can buy or sell FLUID directly against USDT. Simply log in to your BingX account, search for the

FLUID/USDT pair, and choose between a

market order for instant execution or a limit order at your preferred price.

2. Long or Short FLUID on Futures Market Trading

FLUID/USDT perpetual contract on the futures market, powered by AI Bingo

For active traders, BingX also offers

FLUIDUSDT perpetual contracts. You can go long (buy) if you expect the price to rise or short (sell) if you anticipate a decline. Set your leverage level up to 100x, though beginners are advised to start with 2–3x, manage your margin carefully, and use BingX AI to monitor liquidation risks, support/resistance zones, and market sentiment before entering trades.

Futures trading is more advanced but offers flexibility to profit in both bullish and bearish conditions.

How Beginners Can Use Fluid Protocol: Step-by-Step Guide

Here’s a step-by-step guide to dipping your toes into Fluid’s features:

1. Set up a wallet, such as MetaMask on Ethereum or one of its supported chains, such as Arbitrum, Base, Polygon.

2. Acquire a supported token, e.g. USDC, USDT, ETH.

3. Deposit / Supply into Fluid’s lending protocol to earn yield passively.

4. If desired, open a vault:

• Deposit collateral.

• Borrow an amount; choose to utilize Smart Debt if available.

• The borrowed portion can also be active liquidity.

5. Participate in DEX: your vault or collateral positions act as liquidity in pools, earning fees.

6. Use DEX v2 features: explore limit orders, hooks, or customized trading strategies.

7. Monitor health: track your LTV, collateral ratio, and performance.

What Are the Risks to Consider When Trading on Fluid DEX?

Like any DeFi platform, Fluid’s novel design introduces both opportunities and trade-offs. Here are the main risks to keep in mind:

• Smart contract and protocol risk – The system’s complexity expands the attack surface, making it more exposed to bugs or exploits.

• Oracle reliability – Inaccurate or manipulated price feeds could trigger unfair liquidations.

• Token emissions – Unlock schedules and inflation may create supply pressure that weighs on price.

• Adoption dependency – Many of Fluid’s efficiencies require scale; if user growth stalls, the benefits diminish.

• Interdependency risks – Because modules like the DEX and vaults are interconnected, failures in one area could cascade across the system.

Safety and Efficiency Tips: Start with small amounts while you learn the flow, keep initial LTVs conservative to limit liquidation risk, track token unlock schedules since big emissions can pressure price, and stay plugged into Fluid DAO/community channels for parameter changes, proposals, and roadmap updates.

Conclusion: What’s Next for Fluid?

Fluid is entering an important growth phase, with plans to expand to Solana through Jupiter Lend, roll out new vault strategies, and support additional collateral types. Third-party developers are expected to experiment with custom DEX logic, while the Fluid DAO will play a larger role in shaping fees, limits, and integrations. Key token unlocks and evolving governance decisions may influence market dynamics, alongside upgrades to oracles, cross-chain infrastructure, and risk models.

That said, adoption and security remain critical variables. Users should stay mindful of protocol risks, token emissions, and market volatility as Fluid scales, treating its innovations as promising but not without potential downsides.

Related Reading